2026 Latest Survey : Report on YouTube Usage Among 531 Japanese Respondents

- 1. How Often Do Japanese People Use YouTube?

- 1-1. Over 90% of Japanese Access the Platform Weekly

- 1-2. Over 70% of Those in Their 30s and Younger Watch Daily

- 1-3. Approximately 70% of Japanese Men Use YouTube Daily

- 2. How Long Do Japanese People Spend on YouTube Daily?

- 2-1. Half of Users Watch Between 30 Minutes and 2 Hours

- 2-2. Over 40% of Teenagers Watch for 2+ Hours Daily

- 2-3. Differences in Viewing Styles by Gender

- 3. When Do Japanese People Typically Watch YouTube?

- 3-1. Bedtime and Break Times are the Two Major Peaks

- 3-2. Teenagers Watch at Night, While Those in Their 40s Watch During the Day

- 3-3. Differences in Daily Routines by Gender

- 4. What Are the Primary Purposes for Using YouTube?

As of 2026, YouTube has transcended its role as mere video entertainment to establish itself as a vital “Visual Knowledge Infrastructure” supporting the daily lives of people in Japan. Moving away from passive content consumption, users are now choosing YouTube with clear intentions, directly linking their viewing habits to personal knowledge acquisition and problem-solving.

This latest survey uncovers a level of “viewing habitualization” and “deep engagement” that business decision-makers can no longer afford to ignore. With over 60% of users accessing the platform almost every day, this overwhelming frequency suggests that information within videos has become a crucial trigger for building trust and driving purchasing behavior.

Based on fresh data from 531 Japanese respondents as of January 2026, this report analyzes the reality of YouTube usage. It reveals the pragmatic profile of Japanese users who integrate video into their daily routines and actively seek out the information they need.

How Often Do Japanese People Use YouTube?

First, we will examine the extent to which YouTube has become a part of daily life in Japan, organizing the data by overall penetration and specific demographics.

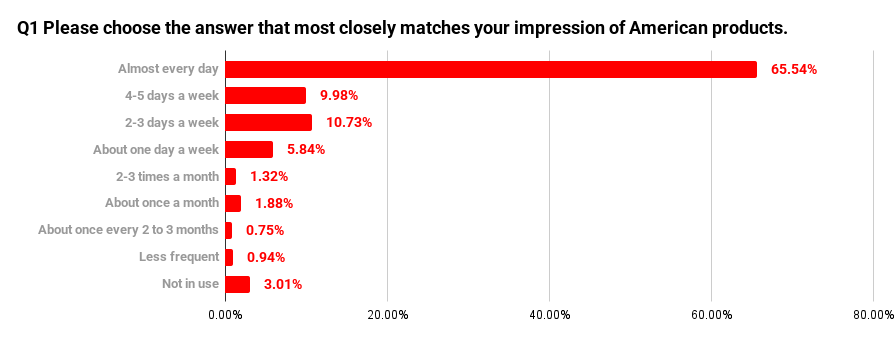

Over 90% of Japanese Access the Platform Weekly

The results from the 531 respondents show that YouTube is now an integral part of life for the vast majority of Japanese people.

The most common response was “Almost every day” at 65.54% (348 people), nearly two-thirds of the total. When combined with “2–3 days a week” at 10.73% (57 people) and “4–5 days a week” at 9.98% (53 people), approximately 86% of Japanese respondents spend more than half the week watching YouTube.

In contrast, infrequent users are a small minority. People who use it “About once a week” accounted for 5.84% (31 people), while those who “Do not use it” represented only 3.01% (16 people).

Other frequencies were negligible: “About once a month” at 1.88% (10 people), “2–3 times a month” at 1.32% (7 people), “Less frequent” at 0.94% (5 people), and “Once every 2–3 months” at 0.75% (4 people).

Overall, it is clear that for modern Japanese people, YouTube has evolved into a “lifestyle infrastructure” deeply embedded in their daily routines.

Over 70% of Those in Their 30s and Younger Watch Daily

Looking at usage by age group, an overwhelming habit of viewing among Japan’s younger generation is evident.

Among teenagers, 80.00% (44 people) responded “Almost every day,” showing a higher level of engagement than any other generation. For those in their 20s and 30s, daily viewing rates remain very high at 72.00% (72 people) and 74.26% (75 people), respectively.

Interestingly, the platform has also significantly penetrated middle-aged and senior groups. Not only do 58.82% (60 people) of those in their 40s watch daily, but even among those aged 70 and over, more than half do so at 53.57% (30 people).

Furthermore, while the percentage of those who “Do not use it” was visible among those in their 60s at 10.34% (6 people) and those 70+ at 7.14% (4 people), it was 0.00% (0 people) for teenagers and those in their 20s.

This suggests that YouTube is an “obvious infrastructure” for younger Japanese and a “daily entertainment” for older generations, with very little disparity in usage frequency across age groups.

Approximately 70% of Japanese Men Use YouTube Daily

Comparing by gender, while both men and women show high usage, the data indicates that Japanese men tend to use the platform more routinely.

Among men, 69.41% (236 people) responded that they watch “Almost every day.” Meanwhile, 58.64% (112 people) of women watch daily—a difference of over 10 percentage points.

Additionally, the percentage of those who “Do not use it” was 1.76% (6 people) for men, compared to 5.24% (10 people) for women.

This suggests that while Japanese women tend to enjoy viewing at specific times between tasks, there is a larger core of Japanese men who proactively engage with YouTube every single day.

How Long Do Japanese People Spend on YouTube Daily?

Next, we analyze how much time Japanese YouTube users actually spend watching videos in a day to understand the depth of their engagement.

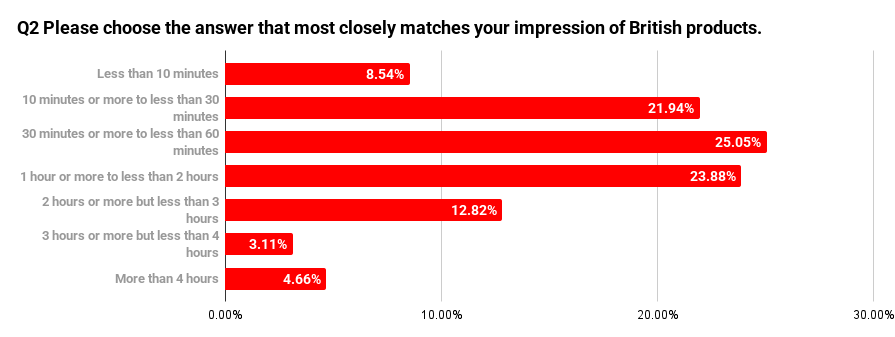

Half of Users Watch Between 30 Minutes and 2 Hours

An analysis of the 515 Japanese YouTube users surveyed shows that the majority spend a significant, concentrated amount of time on the platform.

The highest percentage was for “30 to 60 minutes” at 25.05% (129 people). This was followed by “1 to 2 hours” at 23.88% (123 people) and “10 to 30 minutes” at 21.94% (113 people), meaning these medium-duration viewers account for about 70% of the total.

On the other hand, extremely short or very long immersive viewing is relatively less common. The most casual “Less than 10 minutes” remained at 8.54% (44 people).

Conversely, long-duration viewing was distributed as follows: “2 to 3 hours” at 12.82% (66 people), “4 hours or more” at 4.66% (24 people), and “3 to 4 hours” at 3.11% (16 people).

Overall, it appears that Japanese YouTube usage is not limited to short gaps in the day; it has become established as a way to sit down and enjoy content much like a traditional television program.

Over 40% of Teenagers Watch for 2+ Hours Daily

Comparing viewing times by age, it is clear that younger generations in Japan are more deeply immersed in video content.

The trend among teenagers is particularly striking, with 16.36% (9 people) watching for more than 3 hours. When combined with the “2 to 3 hours” group at 27.27% (15 people), over 40% of Japanese teenagers spend at least 2 hours on YouTube every day.

For those in their 20s and 30s, the “1 to 2 hours” range also remains significant at 27.00% (27 people) and 16.00% (16 people), respectively. For Japan’s younger generation, YouTube viewing is clearly a major form of entertainment that occupies a large portion of their lives.

In contrast, as the age group increases to 50 and older, viewing times tend to become more compact. Among those 70 and older, “30 to 60 minutes” was the most common response at 34.62% (18 people), while only 11.54% (6 people) watched for more than 2 hours.

Differences in Viewing Styles by Gender

Looking at the differences in viewing time by gender, there are subtle variations in how Japanese men and women engage with YouTube.

Among Japanese women, “30 to 60 minutes” was the most common at 27.07% (49 people), and those who finished viewing within an hour accounted for over half at 56.91% (103 people). This suggests that female users often enjoy viewing in well-defined increments, perhaps during gaps in housework or work.

Japanese men also share a similar core group, with “1 to 2 hours” at 24.55% (82 people), but they show a higher tendency for longer viewing sessions compared to women.

The total percentage of those watching for “2 hours or more” was 20.66% (69 people) for men. While the percentage is similar to women (20.44%, 37 people), the absolute number of male users in this category highlights a greater depth of long-form viewing among men.

This indicates a distinction where Japanese men lean toward “immersive viewing” to dig deep into interests, while women prefer “scheduled viewing” that fits into their daily rhythm.

When Do Japanese People Typically Watch YouTube?

This section explores how YouTube is integrated into the daily routines of Japanese people by examining specific usage scenarios.

Bedtime and Break Times are the Two Major Peaks

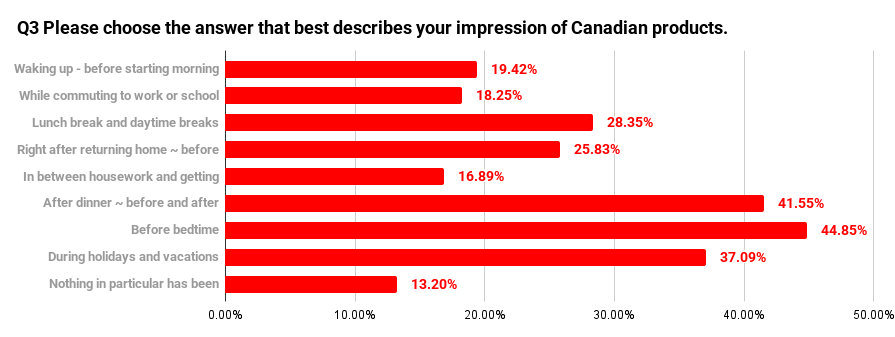

According to the responses from 515 Japanese YouTube users, the platform is used during various “transition points” throughout the day rather than being concentrated in a single time slot.

The most frequent response was “Before bed” at 44.85% (231 people), indicating that ending the day with video content has become a standard habit in Japan. This was followed by “Lunch breaks/Daytime breaks” at 28.35% (146 people) and “After dinner to before/after bathing” at 27.96% (144 people).

Additionally, “Immediately after returning home until dinner” was also high at 25.83% (133 people), showing that people open YouTube as they switch from work or school to “off” mode. Meanwhile, “After waking up until starting morning activities” stood at 19.42% (100 people), “Commuting to work or school” at 18.25% (94 people), and “Between housework or getting ready” at 13.01% (67 people).

These results suggest that YouTube is utilized as a flexible medium that naturally fits into the gaps of daily life, rather than just during dedicated leisure time. Furthermore, “During weekends/holidays” was 20.97% (108 people) and “No specific time” was 10.49% (54 people).

Teenagers Watch at Night, While Those in Their 40s Watch During the Day

Comparing usage timing by age group clearly reflects the different lifestyles of each generation in Japan.

Among teenagers, “Before bed” was exceptionally high at 70.91% (39 people), far outpacing the second-place “After dinner to before/after bathing” at 41.82% (23 people). For the younger generation in Japan, spending relaxing night hours with YouTube has become an essential daily routine.

In contrast, for those in their 40s, “Lunch breaks/Daytime breaks” was the top choice at 37.11% (36 people), surpassing “Before bed” at 32.99% (32 people). Among the working-age generation in Japan, there is a strong tendency to use limited gaps during the day for refreshment, rather than just private time at night.

Additionally, among seniors aged 60 and 70+, the percentage of “No specific time” was higher than in other generations, suggesting they enjoy content whenever they like without being tied to a specific schedule.

Differences in Daily Routines by Gender

Looking at gender, there are clear stylistic differences in when Japanese men and women access YouTube.

For Japanese women, “Before bed” exceeded half at 53.04% (96 people), showing a concentration of viewing during quiet night hours. “After dinner to before/after bathing” was also high at 32.60% (59 people), suggesting that for Japanese women, YouTube serves as a personal tool for unwinding from the day’s fatigue.

While “Before bed” was also the top choice for Japanese men at 40.42% (135 people), it was not as concentrated as it was for women. A notable characteristic for men is that “Commuting to work or school” stood at 22.16% (74 people), which is about double the 11.05% (20 people) reported by women.

Furthermore, “Lunch breaks/Daytime breaks” remained stable for Japanese men at 29.94% (100 people), highlighting their proactive use of YouTube even while away from home or during work intervals.

What Are the Primary Purposes for Using YouTube?

This section examines what Japanese users are looking for when they open YouTube, organizing their specific motivations for using the platform.

“Killing Time” and “Hobbies” are the Two Main Drivers

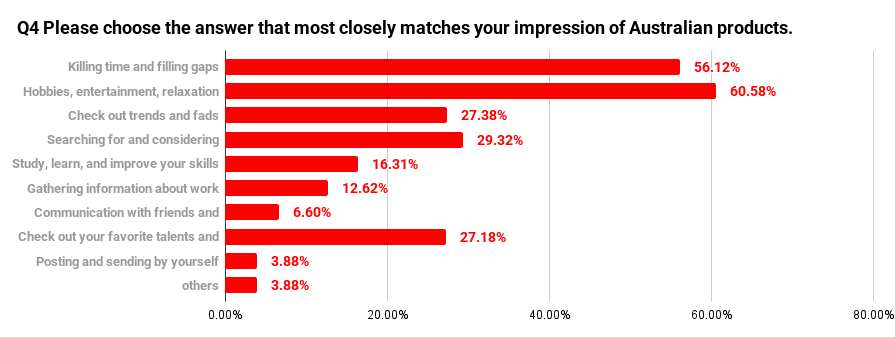

An analysis of 515 Japanese YouTube users reveals that motivations are diverse rather than limited to a single purpose.

The most common reason was “To kill time or fill short gaps” at 69.32% (357 people), gaining overwhelming support as a way to occupy idle moments. This was followed by “Hobbies, entertainment, and relaxation” at 63.88% (329 people), indicating that many Japanese people turn to YouTube for daily enjoyment and stress relief.

Additionally, “Checking trends and what’s popular” at 34.17% (176 people) and “Following favorite celebrities or influencers” at 32.04% (165 people) ranked in the middle, showing the platform’s role as an information source. Furthermore, “Study, learning, and skill-up” stood at 29.13% (150 people) and “Searching for or considering products/services” at 21.94% (113 people), proving its utility as a search engine for practical knowledge and purchasing decisions.

On the other hand, business and direct social interaction remained a minority. “Information gathering for work/business” was 9.51% (49 people), “Others” was 1.75% (9 people), “Posting or broadcasting content myself” was 6.02% (31 people), and “Communication with friends/acquaintances” was 4.47% (23 people). Overall, YouTube serves as a versatile medium for Japanese users, centered on entertainment but covering practical needs like learning and research.

Youth Focus on “People,” While Those in Their 30s Seek “Learning”

Looking at purposes by age group, the role expected of YouTube shifts according to the life stages of Japanese users.

Among teenagers, “Following favorite celebrities or influencers” was the highest across all generations at 56.36% (31 people), making specific individuals a strong motivation for viewing. In their 20s, “Checking trends and what’s popular” remained high at 43.00% (43 people), highlighting YouTube’s role as a trend hub for fashion-conscious young Japanese.

By contrast, for those in their 30s, “Study, learning, and skill-up” reached 35.00% (35 people), showing a clear shift toward utility. Those in their 40s followed a similar trend, with 29.90% (29 people) using it for learning, as they seek to efficiently acquire know-how for work or personal life through video.

For senior groups aged 60 and 70+, “Hobbies, entertainment, and relaxation” became the dominant focus again, with users seeking pure enjoyment and fulfillment over practical benefits. As the generation increases, the role of YouTube shifts from “following trends” to “deepening personal interests.”

Women Seek Trends, While Men Seek Practical Benefits

Gender comparisons reveal clear differences in the value Japanese men and women seek from YouTube.

Japanese women prioritized “Hobbies, entertainment, and relaxation” at 67.96% (123 people), while also outpacing men in “Checking trends and what’s popular” at 38.67% (70 people) and “Following favorite celebrities or influencers” at 36.46% (66 people). For Japanese women, YouTube is an emotional tool used to boost their mood or catch the latest trends.

In contrast, Japanese men showed higher interest in practical items than women, with “Study, learning, and skill-up” at 30.24% (101 people) and “Searching for or considering products/services” at 23.35% (78 people). Notably, “Information gathering for work/business” was 11.08% (37 people) for men compared to 6.63% (12 people) for women, showing that men more actively use YouTube for business and practical research.

While “killing time” remains the top purpose for both, a clear stylistic difference emerged: Japanese women focus on “enjoyment and trends,” while men focus on “knowledge and problem-solving.”

What Types of Accounts Do Japanese Users Primarily Follow?

This section explores which types of channels Japanese YouTube users subscribe to and follow for ongoing updates.

Focus on Celebrities and Influencers

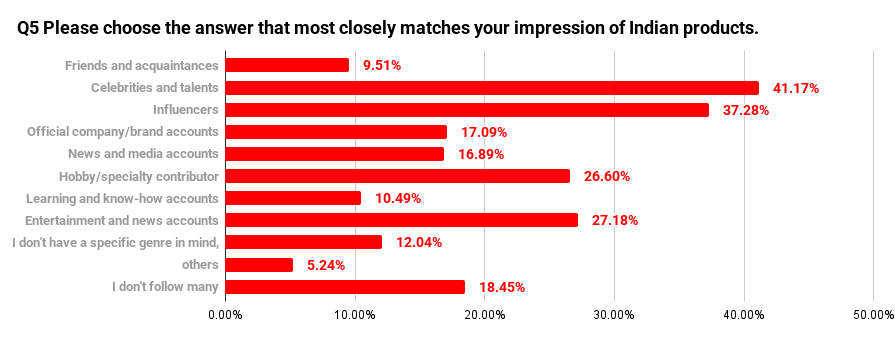

According to the responses from 515 Japanese YouTube users, followers are strongly attracted to individual creators.

The most popular category was “Celebrities and TV personalities” at 46.80% (241 people). This was followed by “Influencers” at 38.25% (197 people) and “Entertainment/Comedy accounts” at 34.56% (178 people), indicating that strong personalities and high entertainment value are major drivers for subscribing.

At the same time, information-oriented and niche accounts also maintain solid support. “Hobby/Specialized field creators” stood at 32.62% (168 people), “News/Media accounts” at 21.94% (113 people), and “Learning/Educational accounts” at 19.42% (100 people). Furthermore, 18.83% (97 people) were subscribed to “Corporate/Brand official accounts.”

Other trends included “Friends/Acquaintances” at 5.63% (29 people) and “Others” at 1.17% (6 people). Additionally, some users do not commit to specific channels: 17.48% (90 people) responded, “I watch whatever is recommended without deciding on a specific genre,” while 12.82% (66 people) said they “Do not follow many accounts.”

Youth Follow Influencers, While Seniors Value Specialists

Comparing follower trends by age group reveals a generational shift in Japan regarding who people trust for information.

Among teenagers and those in their 20s, the subscription rate for “Influencers” is exceptionally high, reaching approximately 60% for teenagers. For young Japanese people, stars born on YouTube are as—or even more—relatable and influential as traditional TV celebrities.

In contrast, as age increases, the presence of “Hobby/Specialized field creators” grows. Japanese users in their 40s and 50s tend to carefully select and follow accounts that offer specialized knowledge to enrich their personal lives or hobbies, rather than just seeking pure entertainment.

Among those aged 60 and older, the percentage of those who “Do not follow many accounts” was higher than in other generations. This suggests a style of passively enjoying videos through recommendation features rather than relying on the subscription function.

Women Follow Personalities, Men Seek Informational Value

Gender comparisons show a difference in values regarding subscription criteria among Japanese men and women.

For Japanese women, “Celebrities and TV personalities” exceeded half at 54.14% (98 people), and “Influencers” stood at 45.30% (82 people), significantly higher than men. For Japanese women, following an account on YouTube often carries a strong sense of empathy or support for a specific “person.”

On the other hand, while “Celebrities and TV personalities” was also the top choice for Japanese men at 42.81% (143 people), the concentration was not as extreme as it was for women. Instead, men are more likely than women to follow “News/Media accounts” or “Corporate/Brand official accounts” for objective information and official announcements.

This highlights a distinct Japanese usage style: women use follow features to “keep up with people they like,” while men subscribe to various genres to “comprehensive cover information of interest.”

YouTube’s Deep Integration into Japanese Life

This survey clearly demonstrates that YouTube is no longer just a video-sharing site, but a vital “lifestyle infrastructure” for the modern Japanese population.

With over 60% of the total population watching daily—and that figure reaching 80% among the younger generation—YouTube has become a powerful information hub, rivaling or even surpassing traditional television. The data shows a landscape where youth are heavily influenced by creators, while those in their 50s and older proactively seek specialized knowledge, highlighting the critical importance of digital marketing in the Japanese market.

At hotice, we have accumulated a wealth of data on social media trends and consumer insights within Japan. Our strength lies not just in tracking numbers, but in our deep understanding of Japanese sensibilities, lifestyles, and the influencer marketing landscape.

If you are looking to launch an effective influencer marketing campaign in Japan or wish to build a strategy based on deep insights into Japanese users, please feel free to contact hotice. We are here to support your brand’s growth with our professional expertise and data-driven solutions.

.png)