2026 Latest Survey : Report on TikTok Usage Among 528 Japanese Respondents

- 1. How Often Do Japanese People Use TikTok?

- 1-1. TikTok as a Mainstay Social Media in Daily Life

- 1-2. Daily Usage as the Standard for Younger Generations

- 1-3. Consistent Daily Habit for Women; Polarized Trends for Men

- 2. How Much Time Do Japanese People Spend Watching TikTok per Day?

- 2-1. TikTok is a Social Media Platform Focused on Short-Burst Viewing

- 2-2. Younger Generations Tend Toward Longer Viewing Sessions

- 2-3. Viewing Trends: Longer Sessions for Women, Short-Term Focus for Men

- 3. When Do Japanese People Most Often Watch TikTok?

- 3-1. High Usage Observed Before Bed and During Breaks

- 3-2. Frequent Use During Commutes and Between Daily Activities

- 3-3. Established Usage on Weekdays, Not Just Weekends

- 4. For What Purposes Is TikTok Used by Japanese People?

In 2026, TikTok has moved beyond being mere “entertainment for gap time” in the lives of the Japanese people, growing into a powerful medium that instantly triggers user emotions and actions through short-form video.

The current survey reveals that over half of all generations are “daily users,” highlighting a reality where unexpected discoveries via algorithms are shaping new consumption styles in Japan.

Based on the latest data from 528 Japanese respondents, this report covers everything from viewing time to usage timing and following trends. It presents the reality of TikTok utilization in 2026: a platform where users instantly consume the “experiences they need now” through unique recommendations, without being dependent on follows.

How Often Do Japanese People Use TikTok?

First, we will examine the overall daily usage of TikTok among the Japanese population, followed by an analysis of the differences across age groups and genders.

TikTok as a Mainstay Social Media in Daily Life

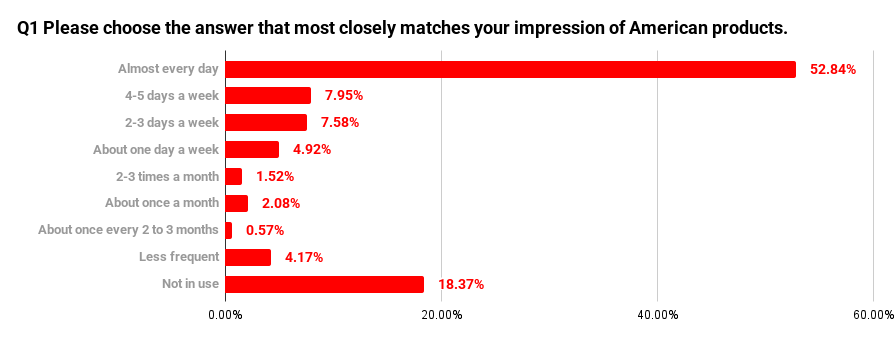

The survey results from 528 Japanese respondents clearly indicate that TikTok has become a staple social media platform in daily life. The most frequent response was “Almost every day,” accounting for more than half at 52.84% (279 people).

The next most common response was “Do not use” at 18.37% (97 people). On the other hand, there is a substantial user base that accesses the app at least once a week: “4–5 days a week” at 7.95% (42 people), “2–3 days a week” at 7.58% (40 people), and “About once a week” at 4.92% (26 people).

Monthly users remain a minority, with “Less frequent than that” at 4.17% (22 people), “About once a month” at 2.08% (11 people), “2–3 times a month” at 1.52% (8 people), and “About once every 2–3 months” at 0.57% (3 people).

Viewed as a whole, TikTok is no longer a platform limited to a specific niche; it has become firmly established as a medium that many Japanese people naturally engage with as part of their daily routine. (Note: For respondents who answered “Do not use,” the survey was concluded at this point.)

Daily Usage as the Standard for Younger Generations

When broken down by age, it is evident that younger Japanese generations are more likely to use TikTok as a daily habit.

In the 10s (teens), 65.45% (36 people) responded “Almost every day.” With “Do not use” at only 12.73% (7 people), it is clear that TikTok is a medium integrated into their everyday lives as a matter of course.

This trend is even more pronounced among those in their 20s, with “Almost every day” reaching 71.00% (71 people). Conversely, “Do not use” is a small minority at 5.00% (5 people), indicating that TikTok is a high-frequency touchpoint for this generation.

From the 30s onward, the rate of daily use slightly decreases. In the 30s, “Almost every day” was 45.10% (46 people), while “Do not use” increased to 20.59% (21 people). In the 40s, “Almost every day” maintained nearly half at 51.96% (53 people), though usage frequency begins to show more variance as the age increases.

Among the 50s, 60s, and 70s+ groups, “Almost every day” gradually declines to 48.28% (28 people), 45.45% (25 people), and 35.71% (20 people), respectively. Meanwhile, “Do not use” rises to 22.41% (13 people), 27.27% (15 people), and 32.14% (18 people).

These findings suggest that TikTok’s positioning shifts from being a “daily-use social media” for the youth to a platform where usage is more polarized among middle-aged and older Japanese populations.

Consistent Daily Habit for Women; Polarized Trends for Men

Looking at gender, different usage patterns emerge within similar numerical ranges.

Among Japanese women, 51.01% (101 people) responded “Almost every day.” Combined with a “Do not use” rate of 17.17% (34 people), it shows a consistent structure of daily engagement among a majority of women.

For men, “Almost every day” also accounted for the majority at 53.94% (178 people), showing no significant difference in daily habit compared to women. However, the “Do not use” rate was slightly higher at 19.09% (63 people).

This indicates that while women tend to use TikTok relatively consistently, Japanese men are more likely to be bifurcated into two distinct groups: those who use it every day and those who do not use it at all.

How Much Time Do Japanese People Spend Watching TikTok per Day?

In this section, we will look at how much time per day is spent watching TikTok on the days it is used. Our focus is on the depth of engagement during each session, rather than just the frequency of access.

TikTok is a Social Media Platform Focused on Short-Burst Viewing

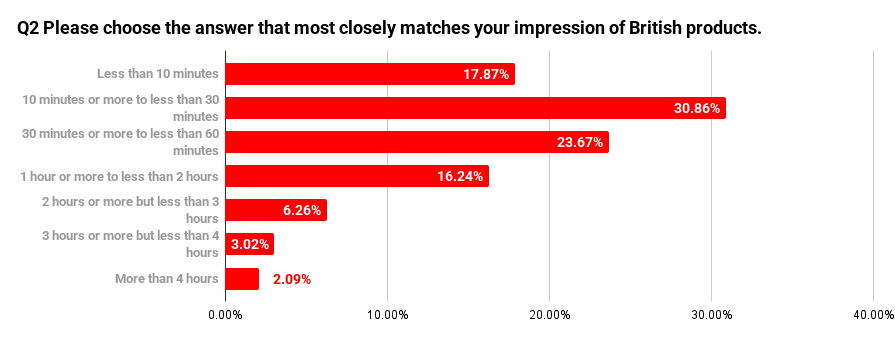

Among the 431 Japanese respondents, the most frequent answer was “10 minutes or more to less than 30 minutes” at 30.86% (133 people).

This was followed by “30 minutes or more to less than 60 minutes” at 23.67% (102 people), meaning more than half of users fall into these categories. Furthermore, “Less than 10 minutes” accounted for 17.87% (77 people). In total, 72.40% (312 people) of Japanese users stay under the one-hour mark.

On the other hand, “1 hour or more to less than 2 hours” was 16.24% (70 people), “2 hours or more to less than 3 hours” was 6.26% (27 people), “3 hours or more to less than 4 hours” was 3.02% (13 people), and “4 hours or more” was 2.09% (9 people).

Overall, the data suggests that TikTok in Japan is used not as a social media platform for long, continuous viewing, but rather as a medium consumed in manageable intervals throughout the day.

Younger Generations Tend Toward Longer Viewing Sessions

When analyzed by age group, clear differences in viewing times emerge among the Japanese population.

In the 10s (teens), those who watch for 30 minutes or more accounted for the majority at 58.18% (28 people). Short-term viewing (less than 30 minutes) stayed at 29.09% (14 people), indicating that younger users primarily enjoy TikTok in consolidated blocks of time.

Among those in their 20s, viewing for 30 minutes or more also exceeded half at 53.00% (50 people), suggesting that the act of viewing itself has become established as a dedicated form of time consumption.

In contrast, among the 30s, the trend shifts: less than 30 minutes was 45.10% (37 people), while 30 minutes or more was 34.31% (28 people), with short-term viewing becoming slightly more dominant. In the 40s, short-term and long-term viewing are almost equal, and from the 50s onward, short-term viewing once again becomes the primary style.

As age increases, TikTok’s role for Japanese users seems to shift from a “social media platform to settle in and watch” to a “social media platform to browse during spare moments.”

Viewing Trends: Longer Sessions for Women, Short-Term Focus for Men

Comparing by gender, there are distinct differences in how Japanese men and women allocate their viewing time.

Among Japanese women, 45.45% (74 people) watch for 30 minutes or more. Since those watching for less than 30 minutes accounted for 37.37% (61 people), there is a visible tendency for women to enjoy TikTok using relatively consolidated time slots.

On the other hand, among Japanese men, less than 30 minutes was the most common response at 41.21% (110 people), while 30 minutes or more was 39.70% (106 people). Compared to women, the male demographic shows a higher composition of people viewing in short, segmented intervals.

It is clear that even on the same platform, many Japanese women engage with TikTok on the premise of spending a certain amount of time, while many Japanese men approach it with the intent of consuming only what is necessary in the moment.

When Do Japanese People Most Often Watch TikTok?

In this section, we will look at the specific timings during the day when TikTok is utilized. By examining trends across different time slots, we can more clearly see how TikTok is integrated into the daily lives of the Japanese people.

High Usage Observed Before Bed and During Breaks

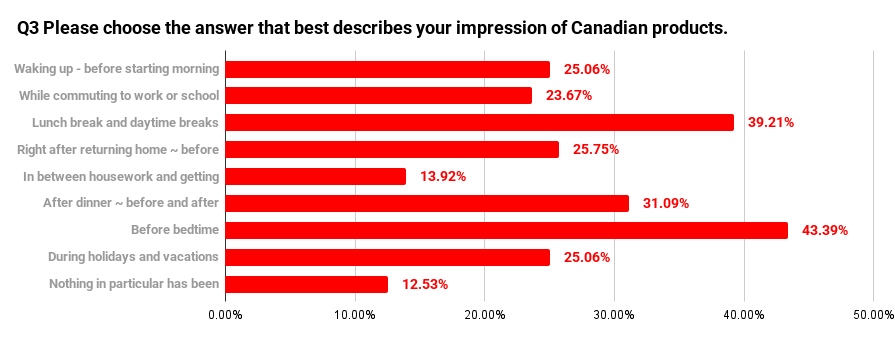

Based on the results from the 431 Japanese respondents, it is evident that TikTok is frequently used during “transitional moments” throughout the day. The most common timing was “Before bed” at 43.39% (187 people).

This was followed by “Lunch break / Daytime rest break” at 39.21% (169 people). It appears that the app is used as a means of quick refreshment in between work or school tasks.

Furthermore, “After dinner to before/after bathing” was also high at 31.09% (134 people), showing that many people open TikTok once their daily chores and errands have settled down. These results suggest a strong trend where TikTok is used as a medium that naturally enters the gaps or the end of daily life, rather than being reserved for “consolidated leisure time.”

Frequent Use During Commutes and Between Daily Activities

Looking more closely at the time slots, TikTok is also widely utilized during commutes and in between various daily routines.

“From waking up to before the morning commute” accounted for 25.06% (108 people), while “Commuting (to work or school)” was 23.67% (102 people). It is likely that many users watch short videos while getting ready in the morning or during travel time.

In addition, “Immediately after returning home until dinner” was 25.75% (111 people), and “In between housework or getting ready” was 13.92% (60 people), showing how TikTok has made its way into daily routines. From this distribution, we can see that TikTok is an extremely flexible medium opened at every “break” in activity, rather than being a social media platform people set aside a specific time to watch.

Established Usage on Weekdays, Not Just Weekends

The percentage of those who responded “Weekends / Holidays” was 25.06% (108 people). While a certain number of people use the app heavily on their days off, this figure is not prominently higher compared to the various usage rates during weekday time slots.

Furthermore, 12.53% (54 people) responded “No specific time decided.” This group likely opens TikTok naturally whenever they feel interested, without being conscious of the time of day. Overall, it appears that TikTok has become established as a medium used throughout the entire week, distributed across daily life, rather than being a social media platform consumed primarily in batches on weekends.

For What Purposes Is TikTok Used by Japanese People?

In this section, we will look at the specific purposes for which TikTok is utilized. Following the data on usage frequency and timing, clarifying “what users are seeking when they open the app” will provide a more concrete understanding of TikTok’s role.

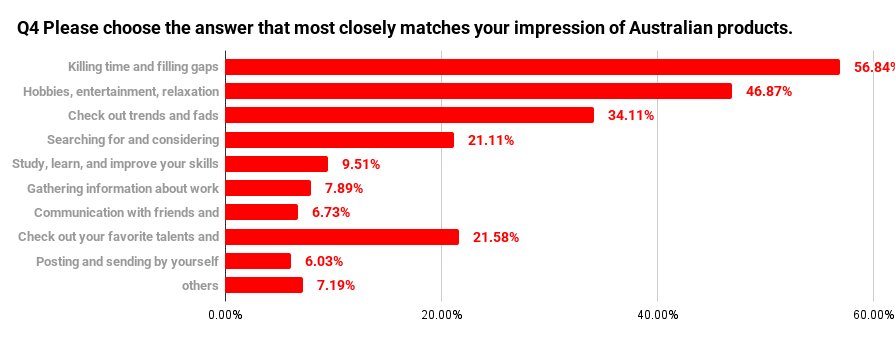

Diverse Purposes Ranging from Killing Time to Information Gathering

The survey results from the 431 Japanese respondents show that the purpose of using TikTok is not limited to just one.

The most common response was “To kill time / Fill gap time” at 56.84% (245 people). This was followed by “Hobbies, entertainment, and relaxation” at 46.87% (202 people), indicating that many people use TikTok for the purpose of casual enjoyment in their daily lives.

Additionally, “Checking trends and fashion” was also high at 34.11% (147 people), showing that in addition to entertainment, it is used by a certain number of people as a means to stay informed about currently popular topics.

In the middle range, “Checking favorite celebrities/influencers” (21.58%, 93 people) and “Searching for or considering products and services” (21.11%, 91 people) were ranked together, suggesting that interest in people and products is naturally integrated into the viewing experience.

On the other hand, those seeking practical information are in the minority, with “Study, learning, and skill-up” at 9.51% (41 people) and “Information gathering for work/business” at 7.89% (34 people).

Furthermore, “Communication with friends/acquaintances” (6.73%, 29 people) and “Posting/distributing by oneself” (6.03%, 26 people) were low, which indicates that TikTok is not a social media platform primarily intended for interaction or self-expression.

“Other” accounted for 7.19% (31 people), showing that a certain number of people use the app in ways that do not fit into specific categories. Viewed as a whole, it can be seen that TikTok is a social media platform where multiple purposes overlap—centered on “killing time and entertainment” while extending to trends, people, products, and information gathering.

Differences in “Enjoying” and “Searching” by Age Group

When looking by age group, both similarities and differences in the purpose of using TikTok emerge.

“To kill time / Fill gap time” accounted for 62.50% (30 people) in the 10s, 42.11% (40 people) in the 20s, and 58.02% (47 people) in the 30s. This shows it is widely used as a means to fill empty moments in daily life, primarily among younger generations. This figure remains around 60% for those in their 40s and older, showing it is a consistent reason across all ages.

Meanwhile, “Checking trends and fashion” was cited by about 30% of those in their 10s, and was also seen at a certain rate in the 20s and 30s. This indicates that for younger generations, the purpose of “knowing what is currently popular” is more likely to overlap with their usage.

“Searching for or considering products and services” accounted for about 10% among those in their 30s and 40s, suggesting that as age increases, the purpose of obtaining practical information is gradually added alongside entertainment. Overall, while “enjoyment” is the central use for all ages, a structure emerges where the purposes of “searching” and “consideration” are layered on as users get older.

Men Lean Toward Information, Women Lean Toward Entertainment

Looking by gender, there are clear differences in the purposes for using TikTok among Japanese respondents.

“To kill time / Fill gap time” was 56.71% (93 people) for women and 56.93% (152 people) for men—almost the same percentage—showing that the goal of casual enjoyment is common regardless of gender.

However, “Searching for or considering products and services” was 6.10% (10 people) for women compared to 11.61% (31 people) for men. This indicates that a certain number of men seek information that leads to judgment or comparison while enjoying the content.

Additionally, for “Information gathering for work/business,” the percentage of men exceeded that of women, showing a trend where more men use TikTok as a practical information source.

In contrast, for women, “Hobbies, entertainment, and relaxation” and “Checking trends and fashion” were relatively more central, suggesting they use TikTok for daily refreshment and enjoyment. Thus, even for the same question regarding “purpose of use,” a clear distinction is highlighted: men lean toward information and judgment, while women lean toward entertainment and mood-changing.

Whose Posts Are Followed on TikTok by Japanese People?

In this section, we will examine what types of accounts are followed on TikTok. By focusing not only on viewing behavior but also on “who users continuously follow,” the nature of relationships on TikTok becomes more specific.

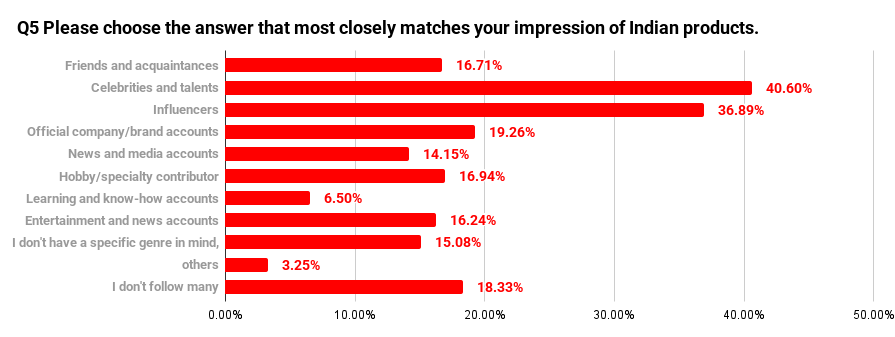

Celebrities and Influencers Are the Primary Follow Targets

Looking at the results from the 431 Japanese respondents, there is a clear bias in the types of accounts being followed.

The most common response was “Celebrities / Talent” at 40.60% (175 people). This was followed by “Influencers” at 36.89% (159 people), indicating that individual creators are the central follow targets on TikTok.

On the other hand, “Official Corporate / Brand Accounts” stood at only 19.26% (83 people); while official accounts are followed by a certain number of users, they do not have the same presence as individual creators.

Additionally, a certain number of follows centered on interest areas and entertainment are observed, such as “Specialized / Hobbyist creators” at 16.94% (73 people), “Entertainment / Comedy accounts” at 16.24% (70 people), and “Friends / Acquaintances” at 16.71% (72 people).

Conversely, “News / Media accounts” at 14.15% (61 people) and “Educational / How-to accounts” at 6.50% (28 people) remain in the minority.

Furthermore, “Often watch posts that flow into the feed without deciding on a specific genre” was 15.08% (65 people), and “Do not follow many accounts” was 18.33% (79 people). This shows that quite a few Japanese users do not rely on follows and instead use the platform centered around the recommendation engine.

Younger Generations Tend to Focus on Following Specific Individuals

Looking by age group, differences in follow targets emerge based on the age of Japanese users.

The percentage of those following “Celebrities / Talent” was highest among teens in their 10s at 52.08% (25 people), followed by those in their 20s at 40.00% (38 people) and 30s at 41.98% (34 people). This shows that younger generations primarily use the platform to track content centered around specific people.

While this remains relatively high in the 50s at 48.89% (22 people), it drops to 15.00% (6 people) for those in their 60s, showing a trend where the emphasis on following individuals decreases as age increases.

On the other hand, “Do not follow many accounts” and “Often watch posts that flow into the feed without deciding on a specific genre” are relatively higher among middle-aged and older groups, suggesting a wider spread of passive viewing that does not rely on follows. Overall, the structure of usage is “follow-based” for younger users and “recommendation-based” for older users.

Men Follow Broadly, While Women Focus on Individuals

Looking by gender, there are also differences in how follow targets are chosen among Japanese respondents.

The percentage of those following “Celebrities / Talent” was 45.12% (74 people) for women and 37.83% (101 people) for men, indicating that women put more weight on following specific individuals.

In contrast, among men, the percentage of those following information-oriented accounts such as “Official Corporate / Brand Accounts” and “News / Media accounts” is relatively high, showing a tendency to follow a wide range of diverse genres.

Additionally, “Do not follow many accounts” was slightly higher among men, indicating that the practice of leaving viewing up to the algorithm is more widespread among the male demographic. Thus, a clear picture emerges where Japanese women have a strong tendency to continuously follow specific people, while Japanese men use TikTok by combining follows with the recommendation engine.

.png)