2026 Update: Social Media Usage Frequency Among Japanese — Insights from a Survey of 528 People

- 1. Which Social Media Platforms Do Japanese Users Use?

- 2. YouTube Is the Most Heavily Used Social Media Platform in Daily Life

- 3. How Frequently Is Social Media Used?

- 4. Most Japanese People Use Social Media Primarily for Entertainment and Passing Time

- 5. Many Japanese Users Become Aware of Products and Services Through Social Media

- 6. The Influence of Social Media on Products and Services Varies Greatly by Platform

- 7. Japanese Social Media Usage Is Built on “Platform Switching”

- 8. Key Takeaways for Social Media Strategy in the Japanese Market Based on the Survey Results

Social media is often said to be deeply embedded in the daily lives of Japanese consumers—but how frequently is it actually used, and which platforms are most prominent?

When viewed from outside Japan, platforms such as LINE, X, and Instagram are often highlighted as dominant domestic channels.

At the same time, there is limited shared understanding of how platforms that are widely used overseas—such as Reddit and Quora—are positioned within the Japanese market.

As part of a 2026 survey, this study examined the social media usage patterns and frequency of 528 Japanese respondents to capture the current reality of SNS engagement.

Rather than presenting a simple popularity ranking, we analyze Japanese information consumption behavior from the perspectives of how intensively platforms are used and where usage is concentrated.

This section serves as foundational data for understanding the Japanese market, offering a clear picture of the current state of social media usage in Japan.

Which Social Media Platforms Do Japanese Users Use?

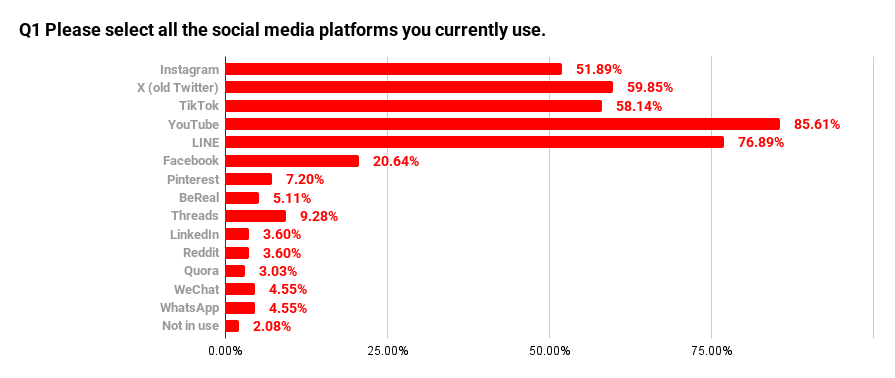

To understand which social media platforms Japanese users currently use, respondents were asked to select all applicable options.

The purpose of this question was to capture the breadth of social media platforms people interact with in their daily lives and to grasp the overall landscape of information exposure in Japan.

The platform with the highest usage rate was YouTube, at 85.61% (452 respondents). This was followed by LINE at 76.89% (406 respondents), indicating that video-based platforms and messaging services are widely used across Japan.

Next came X (formerly Twitter) at 59.85% (316 respondents), TikTok at 58.14% (307 respondents), and Instagram at 51.89% (274 respondents). A notable characteristic is that several major platforms are used concurrently at nearly the same level, rather than one dominating the others.

In contrast, platforms that are frequently used overseas for information gathering and discussion showed very limited adoption in Japan. Reddit was used by only 3.60% (19 respondents), and Quora by 3.03% (16 respondents). These platforms have not yet become common channels for everyday information consumption in Japan.

LinkedIn also recorded a low usage rate of 3.60% (19 respondents). This suggests that, in Japan, business-oriented social networking services are not widely used as part of daily routines.

Overall, these results indicate that social media usage in Japan is not concentrated on a single platform. Instead, users tend to switch between multiple platforms depending on their purpose. The fact that platforms dominant overseas do not necessarily gain traction in Japan is an important characteristic to keep in mind when seeking to understand the Japanese market.

YouTube Is the Most Heavily Used Social Media Platform in Daily Life

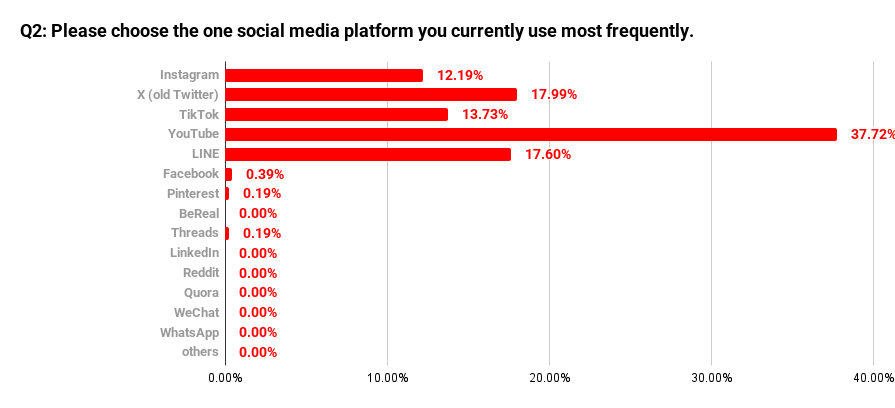

While Q1 examined the overall range of social media platforms used, this question focuses on identifying which platform people spend the most time on in their daily lives. In Japan, where using multiple platforms in parallel is the norm, asking respondents to choose the single platform they use the most helps reveal where actual usage is most concentrated.

The most frequently selected platform was YouTube, at 37.72% (195 respondents). Although YouTube already showed a high usage rate in Q1, it stands out even more clearly as the “most used” platform, indicating that video content sits at the center of information consumption and entertainment for Japanese users.

This was followed by X (formerly Twitter) at 17.99% (93 respondents) and LINE at 17.60% (91 respondents). Platforms oriented toward real-time information updates and everyday communication occupy the next most prominent positions after YouTube.

TikTok accounted for 13.73% (71 respondents), while Instagram came in at 12.19% (63 respondents). Although around half of respondents indicated that they use these platforms in Q1, they are less likely to be chosen as the single most-used social network compared with YouTube, X, or LINE.

Notably, Reddit, Quora, LinkedIn, WhatsApp, and WeChat all recorded 0%. Despite being part of daily life in many overseas markets, none of these platforms were selected as a primary social network in Japan.

These results suggest that while Japanese users engage with a wide range of social media platforms, their day-to-day usage is concentrated on a very limited number of services. The fact that platforms with strong influence overseas do not easily become core channels in Japan offers an important insight for anyone seeking to understand or enter the Japanese market.

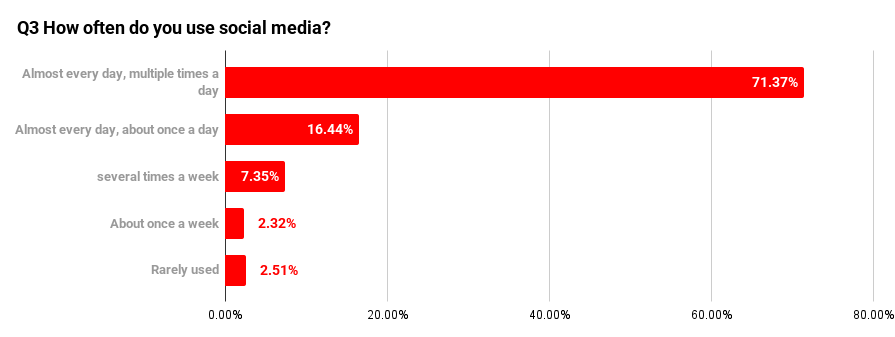

How Frequently Is Social Media Used?

More important than whether social media is used at all is the extent to which it is embedded in everyday life. By examining usage frequency, we can better understand whether social media functions as a daily habit for Japanese users or merely as a supplementary tool.

The largest share of respondents—71.37% (369 people)—answered that they use social media “almost every day, multiple times a day.” This indicates that more than 70% of users check social media repeatedly throughout the day.

When combined with those who reported using social media “almost every day, about once a day,” which accounted for 16.44% (85 people), the proportion of respondents who use social media on a daily basis reaches 87.81%. This shows that social media use in Japan is not an occasional or exceptional behavior, but rather an established part of daily routines.

At the same time, there is a smaller segment of users with lower usage frequency: 7.35% (38 people) use social media “a few times a week,” 2.32% (12 people) use it “about once a week,” and 2.51% (13 people) reported that they “hardly use it at all.”

These results suggest that social media usage in Japan is clearly divided between a majority who use it almost every day and a minority who maintain some distance from it. Not everyone engages with social media at the same level or with the same intensity.

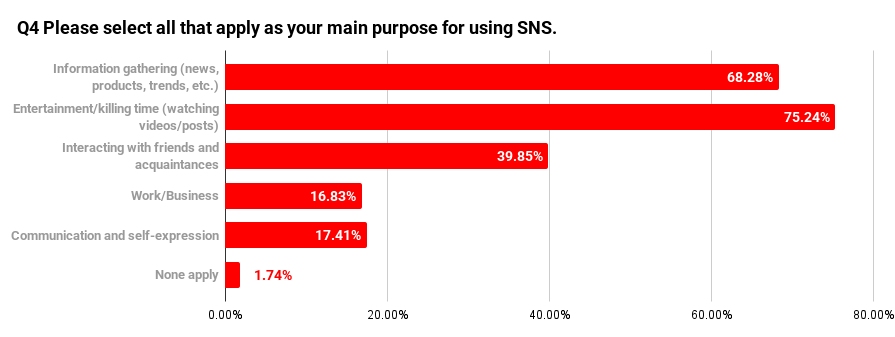

Most Japanese People Use Social Media Primarily for Entertainment and Passing Time

While the high frequency of social media use is clear, frequency alone does not fully explain how Japanese users perceive and position social media in their lives. For this reason, this section examines the roles social media plays in everyday use.

The most common purpose was “entertainment or killing time (watching videos or browsing posts),” selected by 75.24% (389 respondents). This indicates that social media functions strongly as a space for everyday entertainment, even more so than as an information tool.

The second most common response was “information gathering (news, products, trends, etc.),” at 68.28% (353 respondents). Many Japanese users rely on social media to stay aware of what is happening in the world and to discover new information, suggesting that entertainment and information consumption occur in parallel.

“Communication with friends or acquaintances” was selected by 39.85% (206 respondents). While interaction through messaging and comments plays a role, it accounts for a smaller share compared to primarily consumption-based use.

Other purposes included “content creation or self-expression” at 17.41% (90 respondents) and “work or business” at 16.83% (87 respondents), both remaining below 20%. This shows that in Japan, relatively few people use social media actively for publishing content or professional purposes.

Overall, social media usage in Japan is characterized by a strong emphasis on “watching” and “consuming” content, with posting and business-related use playing a secondary role. This usage pattern differs somewhat from the image of social media in many overseas markets, where platforms often serve as spaces for discussion and self-assertion.

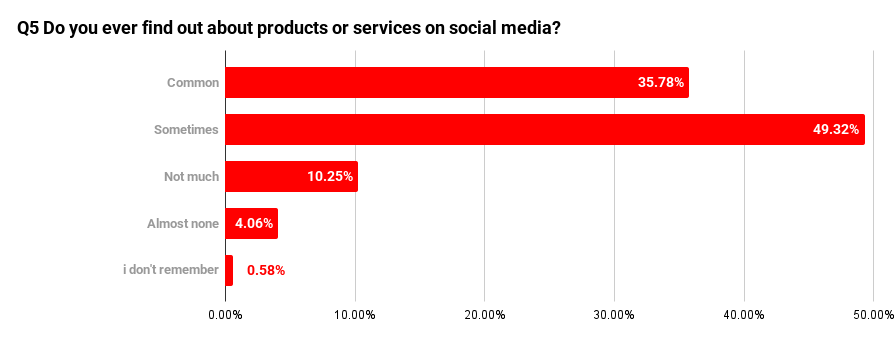

Many Japanese Users Become Aware of Products and Services Through Social Media

As social media use has become part of everyday life, respondents were asked the question, “Have you ever become aware of products or services through social media?” in order to understand their actual exposure to such content.

The most common response was “sometimes,” selected by 49.32% (255 respondents). This shows that encountering products or services on social media is not a special or rare experience, but something that occurs intermittently in daily life.

When combined with those who answered “often,” which accounted for 35.78% (185 respondents), the share of people who have become aware of products or services through social media reaches 85.10%. For many Japanese users, social media has already become a major entry point for information discovery.

At the same time, a certain number of respondents reported limited exposure: 10.25% (53 respondents) answered “rarely,” and 4.06% (21 respondents) said “almost never.” This indicates that even among social media users, there is a segment that does not consistently pay attention to product-related content.

What is important to note here is that this question does not ask whether respondents actually made a purchase, but whether they became aware of a product or service. Japanese users do encounter products and services through social media, but in many cases this exposure is not the result of active searching. Instead, it tends to occur incidentally as part of browsing and entertainment-oriented use.

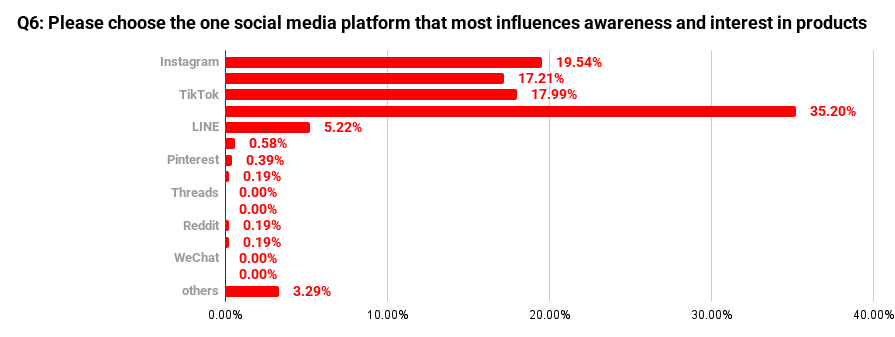

The Influence of Social Media on Products and Services Varies Greatly by Platform

While many people become aware of products and services through social media, this does not necessarily mean that all platforms have the same level of influence on awareness or interest. In this question, respondents were asked to select the single social media platform that most strongly influences them.

The most common answer was YouTube, at 35.20% (182 respondents). As seen in Q2, where YouTube ranked highest as the most frequently used platform, it also occupies a central position as a channel that increases interest in products and services.

This was followed by Instagram at 19.54% (101 respondents), TikTok at 17.99% (93 respondents), and X (formerly Twitter) at 17.21% (89 respondents). Platforms with different characteristics—short-form video, real-time updates, and visually driven content—appear side by side at nearly the same level of influence.

In contrast, LINE accounted for only 5.22% (27 respondents). Although it has a high daily usage rate, its impact on generating interest in products or services is more limited compared with platforms centered on browsing videos or posts.

Reddit and Quora, which are often used overseas as spaces for information exploration and discussion, each recorded just 0.19% (one respondent each). In Japan, cases where these platforms directly influence awareness of products or services remain extremely limited.

In the Japanese market, social media may function more as a place to “feel” and become interested, rather than as a place to actively “research.” Applying strategies designed for overseas markets without understanding this structure may make it difficult to achieve the expected results.

Japanese Social Media Usage Is Built on “Platform Switching”

The previous questions examined usage frequency, purposes, and which platforms most strongly influence awareness and interest. Finally, this section looks at how Japanese users themselves perceive their relationship with social media.

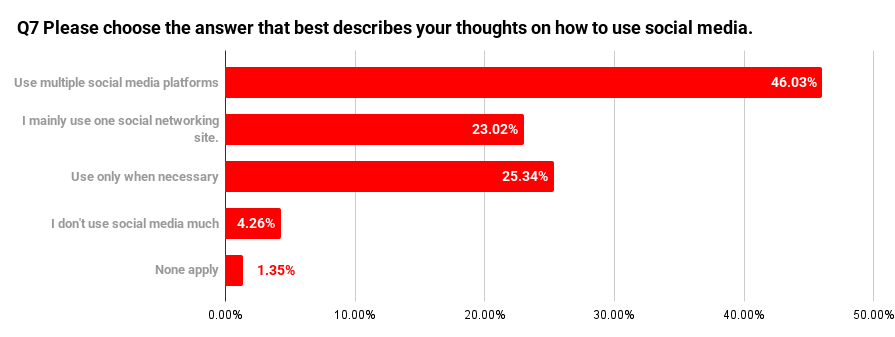

The most common response was “I use multiple social media platforms for different purposes,” selected by 46.03% (238 respondents). Nearly half of Japanese users approach social media with the assumption that they will switch platforms depending on context and need.

This was followed by “I use social media only when necessary,” at 25.34% (131 respondents), and “I mainly use one primary platform,” at 23.02% (119 respondents). A significant number of people adjust their level of engagement rather than remaining constantly connected.

Only 4.26% (22 respondents) answered that they “do not use social media very much.” This indicates that low-frequency users are a clear minority, and that for most Japanese people, social media is integrated into daily life in some form.

Overall, these results show that social media use in Japan is not based on dependence on a single platform, but on deliberate choice and differentiation. Platforms such as YouTube, X, Instagram, and TikTok are used in parallel, each serving a distinct role.

This “distributed” pattern of usage has a major impact on how information is received and how products and services are communicated. To understand the Japanese market, it is essential not only to consider which platforms are used, but also how they are combined and positioned within users’ daily lives.

Key Takeaways for Social Media Strategy in the Japanese Market Based on the Survey Results

This survey shows that while social media usage among Japanese users is very frequent, it is built on the assumption of switching between multiple platforms rather than relying on a single one. YouTube plays a central role, but other platforms with different functions are used in parallel depending on purpose and context.

The results also indicate that Japanese users primarily use social media for entertainment and information gathering. When it comes to products and services, most interactions occur at the “awareness” stage prior to purchase, with social media serving as a point of initial exposure rather than a direct driver of transactions.

In the Japanese market, it is essential to design strategies based on multiple touchpoints rather than depending on a single platform. Instead of applying approaches that are common overseas without adjustment, a deep understanding of how Japanese users actually engage with social media is required.

At hotice, we conduct research focused on the Japanese market to visualize consumer attitudes and behaviors, providing practical insights for planning social media and influencer marketing initiatives. If you are considering research or strategy development tailored to the Japanese market, please feel free to contact us.

.png)