LinkedIn Japan Market Survey: 63% Awareness, 81% Business Adoption

- 1. Overview of the Japan Survey (256 Respondents)

- 2. 63% of Respondents Recognize LinkedIn

- 3. Usage Frequency: Daily Use Remains Limited, 40% “Rarely Use”

- 4. Primary Purposes of Use: 54% Information Gathering, 31% Business Networking

- 5. Behavioral Impact: 40% Considered a Job Change, 29% Created New Business Opportunities

- 6. Business Use: 81% Have Experience, Spanning Recruitment, Sales, and Market Research

- 7. 90% Report Results, Over 90% Intend to Continue Using LinkedIn

- 8. The Value and Untapped Potential of LinkedIn in Japan

Known as one of the world’s largest business-focused social networking platforms, LinkedIn is widely used overseas as an essential tool for career development and business networking.

In contrast, little systematic data has been available on LinkedIn’s level of adoption and usage in the Japanese market. For global brands and international companies seeking to approach Japan strategically, understanding this reality is a critical perspective.

To address this, hotice conducted a survey on September 26, 2025, targeting 256 social media users in Japan. The study explored LinkedIn’s awareness, frequency of use, purposes, behavioral impact, and business applications, with the goal of visualizing LinkedIn’s positioning in the Japanese market.

Overview of the Japan Survey (256 Respondents)

This survey was conducted to clarify LinkedIn’s awareness, actual usage, and business applications in Japan. The study was led by hotice, a company specializing in influencer marketing, with the goal of providing valuable data for overseas brands and global companies seeking to better understand the Japanese market.

The research was carried out in the form of an online questionnaire, with responses collected from 256 social media users residing in Japan. By including a wide range of ages and professions, the survey enabled a multifaceted understanding of how LinkedIn is recognized and used.

The survey topics extended beyond simple awareness, covering usage frequency, purposes, behavioral impacts such as career and job changes, and corporate adoption and perceived effectiveness.

The survey was conducted on September 26, 2025. With 256 respondents, the dataset is statistically sufficient to reflect meaningful trends and provides significant insights into LinkedIn’s position within the Japanese market.

While LinkedIn has long been an essential platform for business professionals overseas, usage in Japan has previously only been described in fragmented terms. This study helps fill that gap by clearly presenting the current state of LinkedIn adoption in Japan.

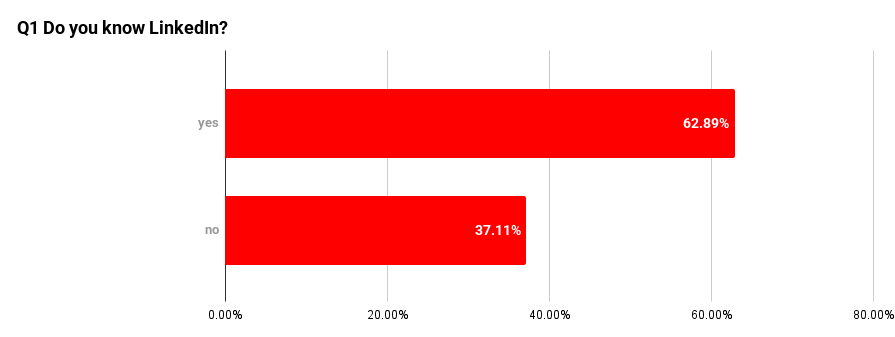

63% of Respondents Recognize LinkedIn

According to the survey, 161 out of 256 Japanese social media users (62.9%) said they were aware of LinkedIn. Meanwhile, 95 respondents (37.1%) reported that they did not know the platform.

This means that while LinkedIn’s presence is recognized by more than 60% of users in Japan, nearly 40% still remain unaware of it. Unlike widely adopted platforms such as Facebook or Instagram, LinkedIn is a business-focused service, which naturally limits its penetration among general users.

However, surpassing the 60% awareness mark suggests that LinkedIn is steadily gaining visibility in the Japanese market. In particular, professionals working at multinational companies and users seeking career advancement are likely already treating LinkedIn as an essential source of information and networking.

Overall, the findings indicate that LinkedIn in Japan is not yet a mass-market platform, but has firmly taken root within its target audience. For companies, the key will be how to nurture the segment that recognizes LinkedIn but has yet to adopt it actively, in order to expand the platform’s role in the Japanese market.

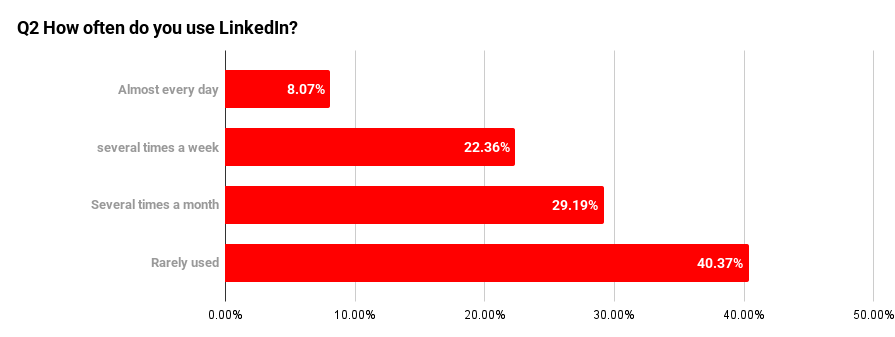

Usage Frequency: Daily Use Remains Limited, 40% “Rarely Use”

Among the 161 respondents who recognized LinkedIn, the survey asked about actual usage frequency. The results showed that daily users are a clear minority. Only 8.1% said they use LinkedIn “almost every day,” and even when combined with those who use it “a few times a week,” the total amounted to just 30.5%.

By contrast, 29.2% reported using it “a few times a month,” while the largest segment—40.4%—said they “rarely use it.” This indicates that for many Japanese users, LinkedIn has not yet become a regular habit.

The findings highlight a sharp gap compared to LinkedIn’s role in overseas markets, particularly in North America and Europe, where the platform is widely used on a daily basis for career development and business networking. In Japan, however, cultural factors—such as the tendency to avoid openly discussing career-related matters—likely limit more active engagement.

That said, nearly 30% of respondents are using LinkedIn on a regular basis, suggesting that this segment has clear and intentional purposes for their use of the platform.

For LinkedIn to establish a stronger presence in the Japanese market, it will be critical to expand the visibility of these active-use cases. Concrete applications—such as recruitment campaigns, professional branding, and business networking initiatives—may serve as catalysts to encourage broader and more consistent adoption.

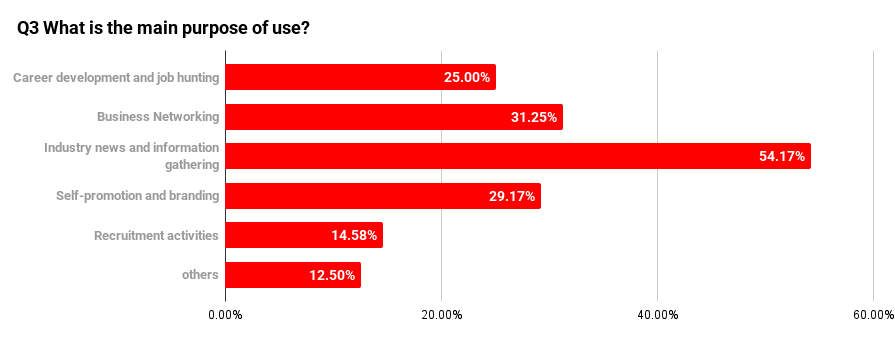

Primary Purposes of Use: 54% Information Gathering, 31% Business Networking

When asked about the actual actions they had taken through LinkedIn, the most common response was “deepened industry knowledge” (42.7%). This suggests that many Japanese users rely on LinkedIn as a learning and information-gathering tool, making it a platform not just for networking but also for staying updated on professional trends.

The second most common action was “considered or pursued a career change” (39.6%). Exposure to job postings—particularly from global firms and startups—appears to stimulate interest in exploring new career opportunities, reflecting LinkedIn’s role as a driver of career awareness in Japan.

Meanwhile, 29.2% reported that they had “gained new business opportunities” and the same percentage “connected with new clients or partners.” These findings indicate that LinkedIn is effectively leveraged in B2B contexts, where real business discussions and collaborations are often initiated through professional connections.

On the other hand, 13.5% of respondents answered “none,” showing that there remains a segment of users whose engagement with LinkedIn has not yet translated into concrete actions.

Overall, the findings highlight LinkedIn’s tangible influence on user behavior in Japan, particularly in shaping important decisions related to knowledge-building, career shifts, and business development. For companies, this demonstrates LinkedIn’s value as both a marketing and recruitment platform.

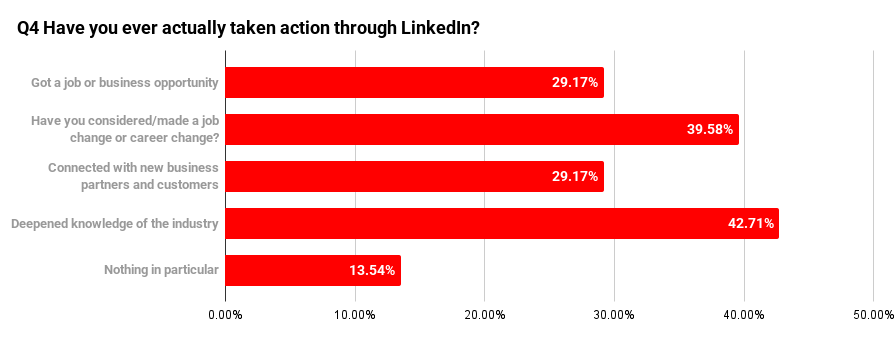

Behavioral Impact: 40% Considered a Job Change, 29% Created New Business Opportunities

The survey also examined how LinkedIn usage has influenced users’ real-world actions. The most common impact was “considering a job change” (40.2%), showing that LinkedIn often prompts users to explore new career possibilities. In particular, exposure to job postings from multinational companies and startups appears to increase interest in the job market.

The second most common response was “led to new business opportunities or partnerships” (28.3%). This highlights cases where LinkedIn connections resulted in business deals or collaborations, underscoring its effectiveness in B2B contexts. Compared to other social platforms, LinkedIn’s foundation on real identities and professional histories increases credibility, making it a trusted channel for concrete business opportunities.

Additionally, 18.7% of respondents said they had purchased a product or service as a result of LinkedIn use. These purchases were not limited to consumer goods but often included work-related tools, business books, and online services, reflecting LinkedIn’s professional focus.

Another 21.5% reported that LinkedIn motivated them to pursue certifications or learning for career advancement, indicating the platform’s role in encouraging self-development and skill-building, not just job mobility.

Taken together, the findings confirm that LinkedIn in Japan has the power to drive tangible behavioral changes. Its influence on major decisions such as career moves and new business deals makes it a highly relevant platform for companies seeking to leverage LinkedIn for marketing, recruitment, and strategic growth.

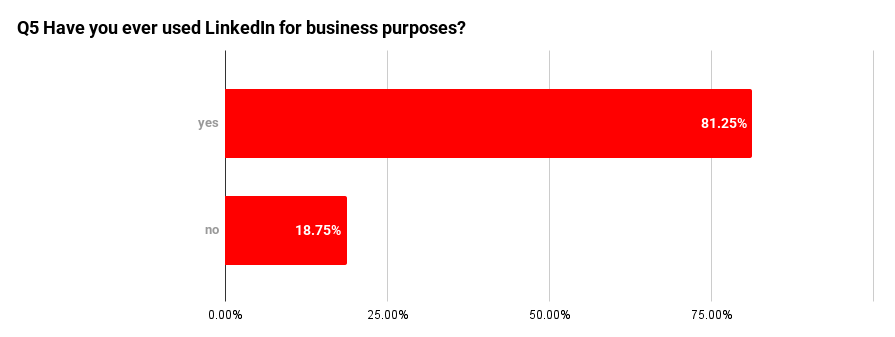

Business Use: 81% Have Experience, Spanning Recruitment, Sales, and Market Research

When asked whether they had used LinkedIn for professional purposes, 81.3% of respondents said yes. This indicates that in Japan, LinkedIn is not only a personal tool but is also being actively leveraged in business settings.

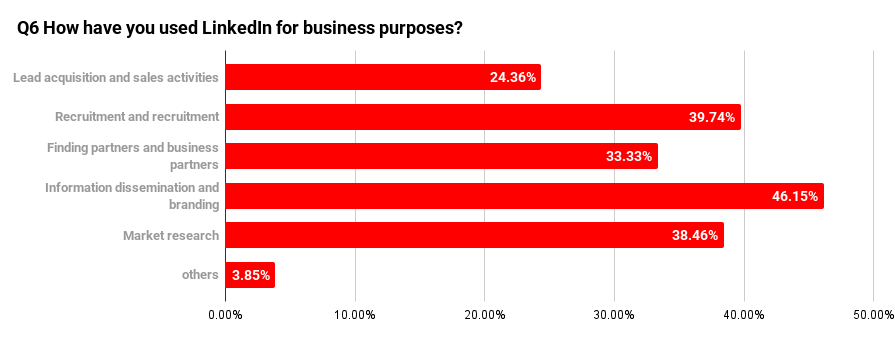

The most common use case was “brand communication and information sharing,” cited by 46.2% of respondents. Companies and individuals alike are leveraging LinkedIn to strengthen their brand presence and showcase professional expertise, positioning the platform as a trusted channel for thought leadership.

The second most cited use was recruitment (39.7%). LinkedIn functions not only as a place for companies to find candidates but also as a channel where job seekers can research corporate culture and connect with hiring managers, fostering mutual understanding between employers and talent.

Market research and competitive intelligence followed at 38.5%, with many marketing and corporate strategy professionals reporting they rely on LinkedIn to track industry trends and monitor competitor activity. Partner and client prospecting was also significant, mentioned by 33.3% of respondents.

Sales and lead generation, while less common, was still noted by 24.4%. Respondents pointed out that LinkedIn’s real-name registration and transparent career histories enable more credible business approaches compared to other social networks.

Lastly, 3.9% selected “other,” which included activities such as community engagement and expert discussions.

Taken together, these findings show that for Japanese professionals, LinkedIn is evolving beyond a simple networking tool into a practical business platform that directly supports branding, recruitment, sales, and market intelligence. The high rate of business-use experience underscores that LinkedIn is steadily establishing itself in the Japanese corporate landscape.

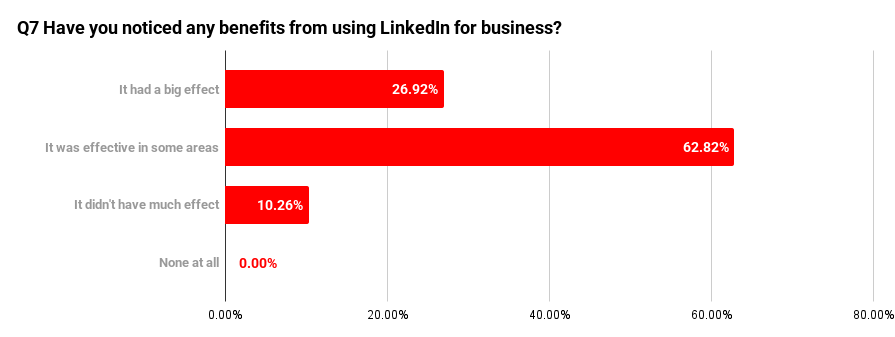

90% Report Results, Over 90% Intend to Continue Using LinkedIn

Among respondents who had used LinkedIn for business purposes, 89.7% reported experiencing some form of positive outcome.

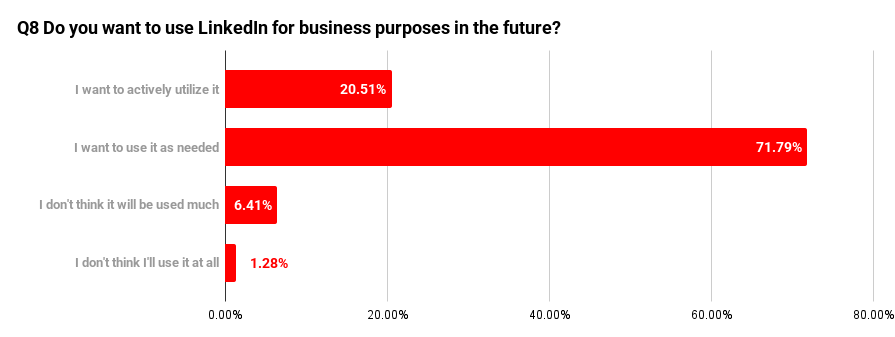

Future intentions showed even stronger results.

A total of 92.3% of users said they plan to continue using LinkedIn, underscoring both the platform’s credibility and practical value in professional settings. This indicates that LinkedIn is recognized not as a temporary tool but as a platform capable of delivering sustained business outcomes.

As the domestic user base continues to grow, LinkedIn’s networking power and information-sharing value are expected to increase further.

Overall, the survey reveals that LinkedIn in Japan has achieved both strong effectiveness and high continuity of use, steadily establishing itself as a credible business-focused social network. For companies, this represents a timely opportunity to leverage LinkedIn strategically in order to differentiate themselves from competitors.

The Value and Untapped Potential of LinkedIn in Japan

This survey revealed that LinkedIn holds 63% awareness in the Japanese market, giving it a notable presence, though daily usage remains limited. On the other hand, 81% of respondents reported business-use experience, with high effectiveness observed in practical areas such as recruitment, sales, and market research.

Nearly 90% of business users reported tangible results, and over 90% expressed a willingness to continue using LinkedIn, confirming the platform’s proven value in Japan. While LinkedIn is not yet a mass-market tool domestically, the findings highlight substantial room for growth. For companies aiming for global expansion, leveraging LinkedIn in Japan represents an opportunity that cannot be overlooked.

At hotice, we support businesses with influencer marketing and social media strategies informed by data-driven insights such as this. If you are interested in exploring how LinkedIn—or other social platforms—can be leveraged effectively in Japan, we invite you to reach out for a consultation.

.png)