What Makes an Overseas Brand Feel Trustworthy? Insights from a Survey of 524 Japanese Consumers

- 1. Survey Overview

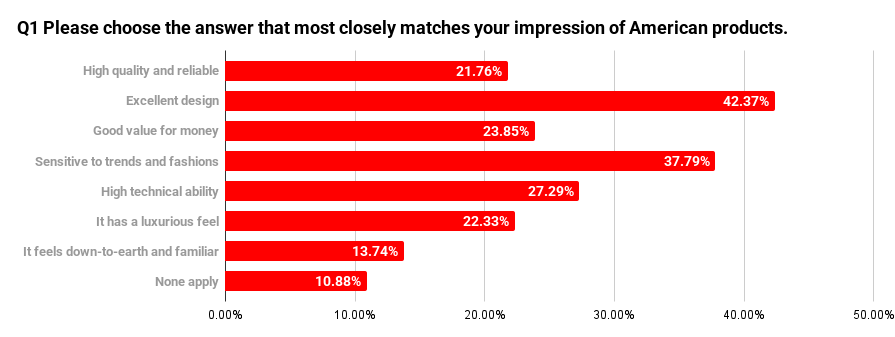

- 2. American Products: Symbols of Trend and Innovation

- 3. British Products: Trust Born from Tradition and Elegance

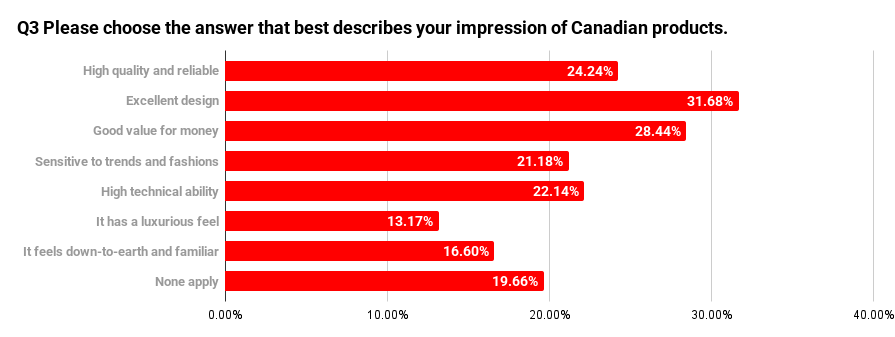

- 4. Canadian Products: Steady and Well-Balanced Impressions

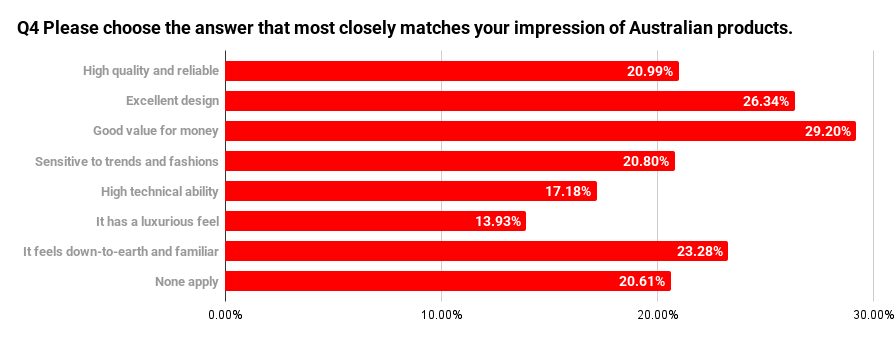

- 5. Australian Products: Natural and Approachable

- 6. Indian Products: Valued for Practicality and Affordability

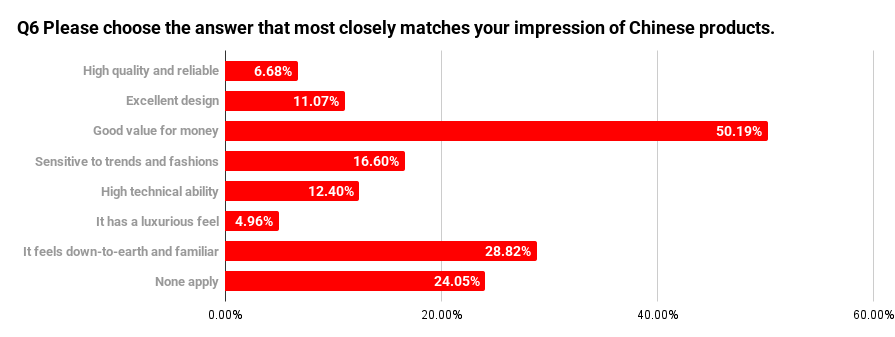

- 7. Chinese Products: Balancing Cost Performance with Mixed Perceptions

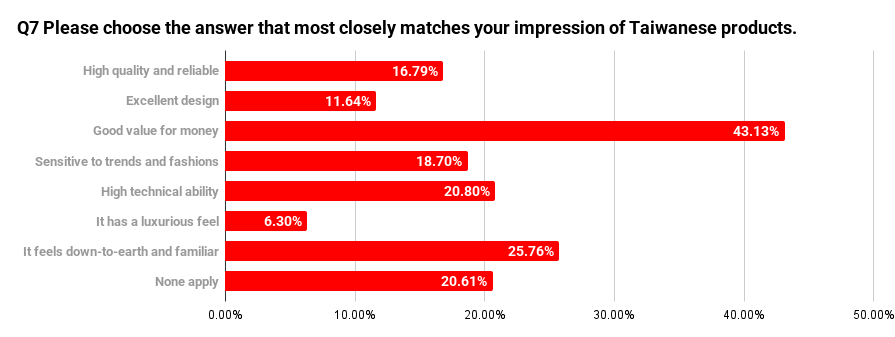

- 8. Taiwanese Products: Reliable Quality and Technical Strength

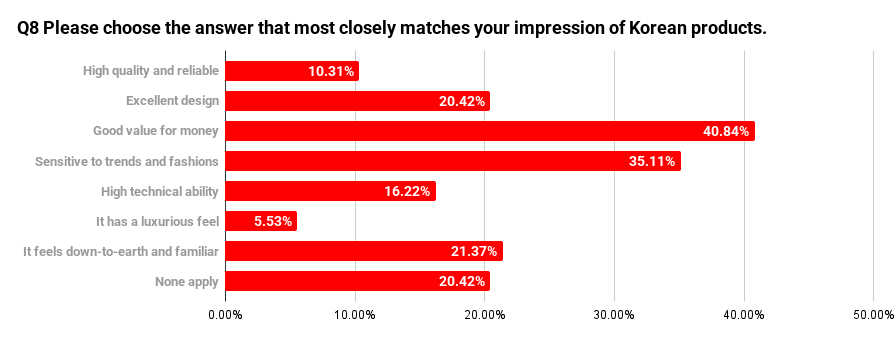

- 9. Korean Products: Balancing Trends and Affordability

- 10. Conclusion: How to Leverage the Different “Value Axes” by Country

- 11. For Influencer Marketing in Japan, Trust hotice

Japanese perceptions of foreign products vary strikingly depending on the country of origin. Many people carry general impressions such as “American products are cutting-edge and stylish,” “British products are elegant and trustworthy,” or “Asian products are affordable and practical.”

But what do Japanese consumers actually think about products from different countries? To find out, we conducted a survey of 524 men and women across Japan, mapping the distinct brand images that emerged for each country. The results revealed that values such as “design,” “cost performance,” and “trust” are clearly divided along national lines.

In this article, we explore how Japanese consumers perceive overseas brands through the lens of these findings. Hidden within the data are valuable insights that can inform future marketing strategies and brand positioning.

Survey Overview

We conducted a survey of 524 men and women across Japan to understand their impressions of foreign products. The survey focused on eight countries: the United States, the United Kingdom, Canada, Australia, India, China, Taiwan, and South Korea.

For each country, respondents were asked to select, on a multiple-response basis, which impressions applied from the following eight categories: “quality,” “design,” “cost performance,” “trendiness,” “technical strength,” “luxury,” “affordability,” and “none of the above.”

The purpose of the survey was to clarify what kinds of values Japanese consumers associate with products from each country.

American Products: Symbols of Trend and Innovation

When it comes to American products, many respondents associated them with “outstanding design” (42.4%) and being “trend-sensitive” (37.8%). “Technological strength” (27.3%) and “high quality” (25.4%) also ranked high, showing that American goods are valued for both functionality and creativity.

For Japanese consumers, American products carry a strong image of being cutting-edge and trustworthy. This impression is largely shaped by global brands such as Apple and Nike. Beyond technical performance, American brands are often seen as “driving the times,” symbolizing innovation and cultural leadership.

The country’s role as a hub for entertainment and technology further reinforces this view. Japanese consumers tend to perceive the U.S. as a nation that creates trends and sets global standards.

Interestingly, relatively few respondents associated American products with “luxury.” This reflects a distinctively American emphasis on rational value—where high price does not necessarily equate to high-end status. Instead, U.S. brands are often chosen for the experience and lifestyle they represent, rather than exclusivity.

In short, American products are defined by three key attributes: “trend,” “innovation,” and “trust.” The balance of appealing design with solid technical capabilities is what makes American brands stand out in the Japanese market.

British Products: Trust Born from Tradition and Elegance

For British products, “outstanding design” stood out most strongly (50.8%), followed by “luxury” (31.3%) and “trend-sensitive” (31.5%). Overall, British goods are associated with a refined, high-quality image—valued in a way distinct from American products.

Many Japanese consumers view British products through the lens of “calmness,” “trust,” and “tradition.” This perception is rooted in iconic brands such as Burberry and Rolls-Royce, which symbolize long histories and exceptional craftsmanship. Rather than flashiness, the appeal lies in meticulous construction and a sense of dignity.

British products are also distinctive for their fusion of classic and contemporary. They maintain traditional style while embracing modern sensibilities, resulting in impressions that resonate across generations as “quietly stylish” and “intelligent and trustworthy.”

This unique balance sets British brands apart from the “innovation-driven” image of American products. Instead of chasing trends, they project a “quiet strength” grounded in history and culture—an approach that strikes a deep chord with Japanese consumers.

Canadian Products: Steady and Well-Balanced Impressions

Evaluations of Canadian products are generally calm and stable. “Outstanding design” (31.7%) and “good cost performance” (28.4%) ranked almost evenly, showing no extreme bias in perception. Rather than being associated with flashiness, Canadian goods are often valued for their sense of sincerity and reliability—qualities that align closely with Japanese values.

What stands out is the relatively low association with trendiness or luxury. Instead, Canadian products are appreciated for their balance of quality and price—a sense of being “just right.” Without aggressively pushing brand image, they earn trust naturally, which reflects a distinctly Canadian character.

Canada’s reputation for environmental protection and sustainable production also contributes to its positive image. Particularly in outdoor gear and everyday goods, consumers link Canadian products with “honest craftsmanship” and “harmony with nature.” This makes them brands that people feel comfortable using for the long term.

While Canadian products may not exhibit strong, flashy individuality, their understated presence actually strengthens consumer trust. Chosen not for extravagance but for dependability, Canadian brands have secured a solid and lasting reputation.

Australian Products: Natural and Approachable

For Australian products, the most common associations were “good cost performance” (29.2%) and “down-to-earth and accessible” (23.3%). Rather than being valued for luxury or flashiness, they are appreciated as an unpretentious quality that fits seamlessly into everyday life.

This impression is strongly influenced by the many skincare and household brands that emphasize natural ingredients. Their eco-friendly and sustainable image resonates well with Japanese consumers, who connect Australian products with ideas like “effortless style” and “authentic comfort.”

Australia is also a familiar country to many Japanese through tourism and study abroad, which contributes to the sense of closeness and reassurance felt toward its products. Consumers tend to favor practicality that blends naturally into daily life, rather than bold designs or premium pricing.

Overall, Australian products are described with keywords such as “natural,” “honest,” and “comfortable.” Instead of asserting brand presence loudly, they are valued for their ability to fit into consumers’ lifestyles in a supportive, approachable way.

Indian Products: Valued for Practicality and Affordability

For Indian products, the most common associations were “good cost performance” (44.9%) and “down-to-earth and accessible” (33.0%). Affordability is clearly a strong factor influencing purchase decisions.

But it is not just about low prices—many consumers also appreciate the ease of use and practicality of Indian goods. Japanese consumers often perceive them as having “all the necessary functions” and being “free of unnecessary frills.” This focus on functionality over decoration is seen as a positive trait.

Behind these impressions is India’s broader image as a hub of intellectual strength, shaped by the growth of its IT sector and large pool of skilled engineers. The country’s reputation for education and startups has enhanced trust in its products, giving consumers confidence that even affordable items maintain a certain level of quality.

Overall, Indian products are regarded less for glamour and more for their honest practicality. For Japanese consumers, they are positioned as a smart, realistic choice—brands to consider when making sensible, value-driven purchases.

Chinese Products: Balancing Cost Performance with Mixed Perceptions

For Chinese products, more than half of respondents highlighted “good cost performance” (50.2%), followed by “down-to-earth and accessible” (28.8%). Price clearly stands out as their greatest strength.

At the same time, 24.0% answered “none of the above,” showing that perceptions are divided. While many consumers are attracted by affordability and convenience, others express uncertainty about quality and vary in their level of trust toward Chinese brands.

This polarization reflects the wide variety of Chinese products. In categories such as smartphones and home appliances, high-quality manufacturers have emerged, while at the same time, a large number of unbranded items still exist. As a result, consumers find it difficult to evaluate Chinese goods as a whole. There are those who say “cheap and good enough,” and others who feel “there’s a risk of inconsistency.”

That said, the old stereotype of “cheap equals poor quality” is gradually fading. With Chinese companies advancing in technology, more consumers now associate certain categories—such as electronics and telecommunications—with improved quality and more sophisticated design.

Ultimately, Chinese products embody a tension between price appeal and quality expectations. For Japanese consumers, they are seen as brands worth trying, but ones that require careful selection.

Taiwanese Products: Reliable Quality and Technical Strength

For Taiwanese products, the top association was “good cost performance” (43.1%), followed by “down-to-earth and accessible” (25.8%) and “high technological strength” (20.8%). This shows that Taiwanese goods are valued for their balance of affordability and reliable quality.

Taiwan is globally recognized for its leadership in semiconductors and electronics. As a result, many Japanese consumers view Taiwan as a “trustworthy and dependable technology hub.” The emphasis on performance and stability over flashy design is reflected in how Taiwanese products are perceived.

Taiwanese brands also tend to avoid excessive advertising or ostentatious presentation, giving them an image of sincerity and straightforwardness. This “quiet competence” has contributed to long-term trust. Even without making a big splash, they deliver consistent quality—something that resonates strongly with Japanese consumers.

Overall, Taiwanese products are positioned as brands chosen for reliability rather than showiness. Their combination of stable performance and reasonable pricing provides reassurance, making them a preferred choice for those who value practicality and trust.

Korean Products: Balancing Trends and Affordability

Korean products are becoming an increasingly familiar part of daily life for Japanese consumers. The top associations were “good cost performance” (40.8%) and “trend-sensitive” (35.1%), followed by “outstanding design” (20.4%). Affordable pricing combined with stylish appeal has earned them strong support.

Cultural influences such as K-pop and Korean dramas also play a major role, reinforcing the impression that Korean products are “stylish and trend-conscious.” From cosmetics and electronics to fashion, Korea is widely seen as a country that sets trends across multiple categories.

Another defining characteristic of Korean brands is their speed of product development and responsiveness to consumer feedback. This flexibility aligns well with younger Japanese consumers, who are always seeking newness. For those who value individuality over sheer quality, Korean products provide an accessible way to incorporate a sense of “what’s current.”

In recent years, Korean products have also gained recognition internationally for their design and quality. The perception has shifted from “cheap and convenient” to “sophisticated yet practical,” marking a significant evolution in their image.

Korean brands are thus positioned in the Japanese market as a unique combination of trendsetting influence and realistic pricing, steadily establishing themselves as a distinct presence.

Conclusion: How to Leverage the Different “Value Axes” by Country

This survey revealed that Japanese consumers evaluate foreign products using different criteria depending on the country of origin. For Western nations such as the United States and the United Kingdom, “design,” “luxury,” and “trust” were highly valued.

In contrast, for countries like China and India, the emphasis was placed on “cost performance” and “practicality.” Taiwan and South Korea fell somewhere in between, perceived as offering a stable balance of both quality and design.

These tendencies show that “country of origin” is not just a matter of geography, but is recognized by Japanese consumers as a form of brand image.

For Americans, it is innovation. For the British, refinement. For China, affordability. For Korea, trendiness. Japanese consumers, often unconsciously, attach distinct expectations and values to products from each country.

For overseas brands aiming to build trust in the Japanese market, the key lies in expressing their national identity in the right way. Luxury positioning calls for highlighting proven quality and aesthetic sophistication. In cost-conscious segments, emphasizing affordability and reassurance is more effective. Success depends on understanding each country’s strengths and aligning messaging with the emotional expectations of Japanese consumers.

Ultimately, the findings demonstrate that a nation’s image directly influences product choice. Leveraging these unique strengths through tailored brand strategies will be the key to achieving success in Japan’s competitive market.

For Influencer Marketing in Japan, Trust hotice

Japanese consumers look beyond price and design—they pay close attention to a brand’s cultural background and attitude. That’s why overseas brands seeking to build trust in Japan must communicate with a deep understanding of local culture and values.

At hotice, we specialize in influencer marketing with a strong focus on Asia, and particularly Japan. Our multinational team offers end-to-end support, from matching the right influencers for your industry and goals, to campaign planning and performance tracking. With extensive experience working with leading companies, we ensure safe and effective promotions grounded in cultural awareness and compliance with local regulations.

If you are considering a strategic influencer campaign tailored to the Japanese market, we invite you to partner with hotice to achieve meaningful results.

.png)