Which Countries’ Products Do Japanese Consumers Distrust? Insights From a Survey of 533 Respondents

INDEX

- 1. U.S.-Made Products: The Challenge Lies in Localization for the Japanese Market

- 2. UK-Made Products: “Difficult to Use” Stands Out More Than Functional Issues

- 3. Canadian Products: Limited Information and Low Familiarity Influence Perceptions

- 4. Australian Products: Limited Information Strongly Shapes Consumer Perception

- 5. Indian Products: Strong “Quality Concerns” Shape Overall Perception

- 6. Chinese Products: Concerns Over Quality and Counterfeit Risks

- 7. Taiwanese Products: Coexistence of Cautious Quality Perceptions and Generally Neutral Impressions

- 8. Korean Products: Quality Perceptions and Information Clarity as Key Improvement Areas

- 9. Conclusion

- 10. For Influencer Marketing in Japan, Trust hotice

To understand how Japanese consumers perceive foreign-made products, we conducted a nationwide survey targeting general users.

The survey was carried out online and collected 533 valid responses.

Respondents represented a wide range of backgrounds, including company employees, government workers, self-employed individuals, and freelancers.

In this study, we gathered feedback from multiple perspectives—overall impressions of products from various countries, perceived concerns, and evaluation criteria such as design, price, and quality.

In this article, we focus on the countries and items that showed the most distinct differences in perception, organizing and analyzing the value axes Japanese consumers use when assessing overseas brands.

Note: For Q1, respondents were instructed to answer based on their general image of each country’s products, not on any specific product category.

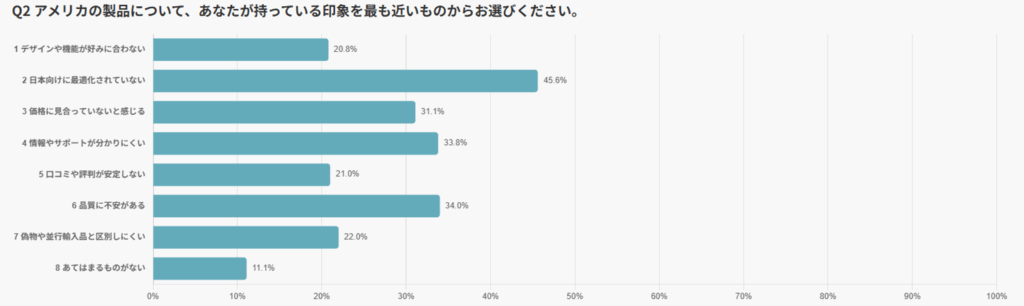

U.S.-Made Products: The Challenge Lies in Localization for the Japanese Market

The most common perception was “not optimized for the Japanese market” at 45.6%.

This was followed by “information and customer support are unclear” at 33.8%, and “does not feel worth the price” at 31.1%.

In contrast, only 20.8% selected “design or functionality does not match my preferences,” which was lower than other concerns.

Taken together, the data suggests that Japanese consumers view U.S.-made products as “attractive, but insufficiently localized for Japan.”

Rather than concerns about the products themselves, respondents pointed to shortcomings in areas such as information accessibility and after-sales support.

From a practical standpoint, expanding Japanese-language information and improving customer support systems are likely to be key factors in building trust.

By reducing post-purchase uncertainty, brands can more effectively improve consumer perception and satisfaction.

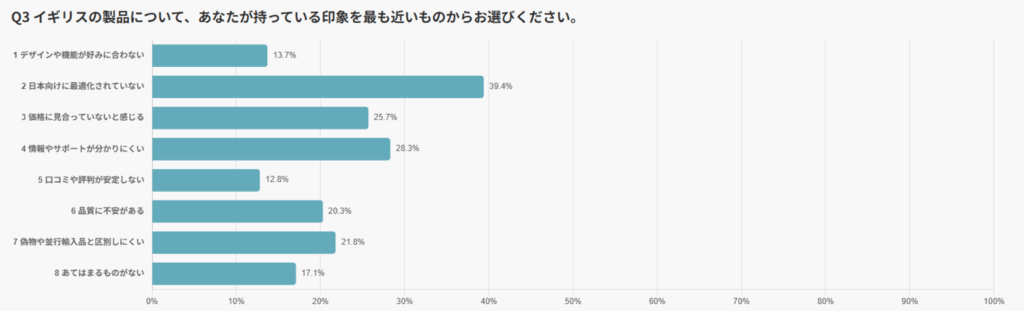

UK-Made Products: “Difficult to Use” Stands Out More Than Functional Issues

The most common perception of UK-made products was “not optimized for the Japanese market” at 39.4%.

This was followed by “information and customer support are unclear” at 28.3%, and “not worth the price” at 25.7%, indicating that many concerns relate to difficulty in understanding or using the product.

Meanwhile, only 13.7% felt that “the design or functionality does not match their preferences,” suggesting relatively low resistance to the appearance or features of British products.

These results imply that, while Japanese consumers show a certain degree of acceptance toward the design and worldview of UK products, they also perceive a lack of sufficient localization and information availability for the Japanese market.

Rather than the products themselves, the “hurdles before starting to use them” may be what leaves a stronger negative impression.

From a practical standpoint, improving Japanese-language information and customer support appears to be key to building trust.

By creating an environment where consumers can use products without confusion before and after purchase, the inherent potential of UK-made products is more likely to be recognized.

Canadian Products: Limited Information and Low Familiarity Influence Perceptions

The most common perception of Canadian products was “not optimized for the Japanese market” at 31.9%.

This was followed by “information and customer support are unclear” at 28.9%, and “does not feel worth the price” at 23.8%, indicating that concerns related to difficulty in understanding how to use the products ranked highly.

A notable point is that 24.4% of respondents selected “none of the above.”

This suggests that many consumers have limited experience with Canadian products or lack a concrete brand image in the first place.

When awareness is low to the point where evaluation criteria cannot be formed, it becomes difficult for consumers to clearly judge strengths or weaknesses.

These findings imply that impressions of Canadian products are shaped less by the quality of the products themselves and more by the lack of available information and limited exposure.

When consumers must evaluate products without sufficient understanding, they are naturally less likely to proceed with a purchase.

From an operational standpoint, providing clear Japanese-language information and offering descriptions that make it easier to imagine real usage scenarios will be important.

Efforts to increase overall brand recognition are also expected to be effective, as creating the first point of contact with consumers can significantly improve how Canadian products are perceived.

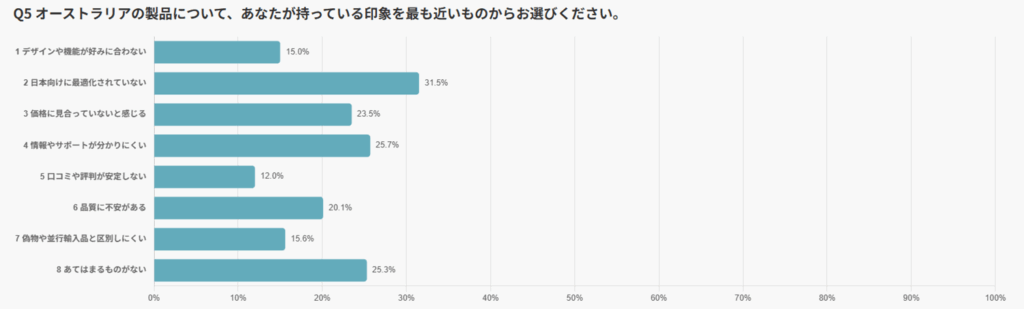

Australian Products: Limited Information Strongly Shapes Consumer Perception

The most common perception of Australian products was “not optimized for the Japanese market” at 31.5%.

This was followed by “information and customer support are unclear” at 25.7%, and “does not feel worth the price” at 23.5%, highlighting a noticeable lack of information needed for product use.

Only 20.1% selected “concerned about product quality,” indicating that extremely negative evaluations are not particularly concentrated.

At the same time, 25.3% chose “none of the above,” suggesting that many consumers may not have strong impressions of Australian products.

This may reflect limited exposure to such products and difficulty recalling concrete characteristics.

Overall, the distribution of responses suggests that perceptions of Australian products are shaped less by strong negative impressions and more by vague, undecided feelings caused by insufficient information.

When consumers lack enough details or comparison points, it becomes harder for them to assess product value—potentially affecting purchase decisions.

From a marketing perspective, providing clear Japanese-language information and offering explanations that help consumers visualize usage scenarios will be essential.

At the same time, strengthening brand presence itself can also improve evaluations; as understanding grows, consumers will have a more solid basis for consideration.

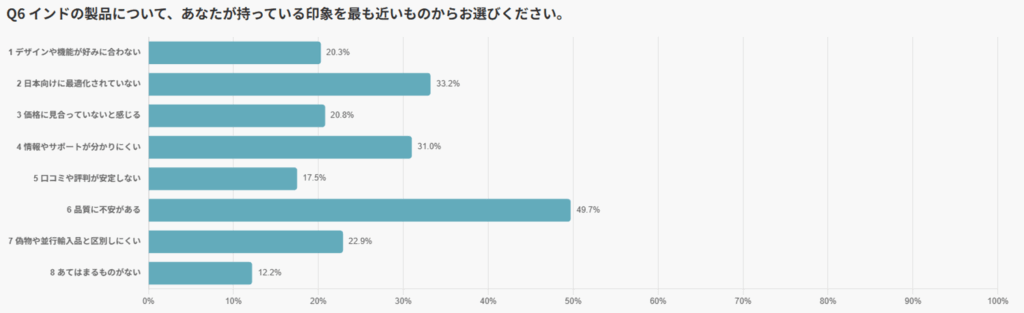

Indian Products: Strong “Quality Concerns” Shape Overall Perception

When it comes to Indian products, the most common perception was “concerned about product quality” at 49.7%, significantly higher than any other category.

This was followed by “not optimized for the Japanese market” at 33.2%, and “information and customer support are unclear” at 31.0%, indicating widespread concerns related to practical usability.

Given this distribution, it appears that evaluations of Indian products often begin with a baseline assumption of quality concerns.

Consumers seem to feel that Indian products do not fully meet their expected quality standards, and this perception may influence how they judge other aspects as well.

As a result, areas such as customer support or localization are also more likely to be viewed negatively—shaped by the overarching concern about quality.

From a market perspective, the ability to clearly communicate quality standards and safety assurances will be crucial for building trust.

Providing transparency about manufacturing processes, certification, and warranty details can help reduce consumer anxiety and contribute to improved evaluations of Indian products.

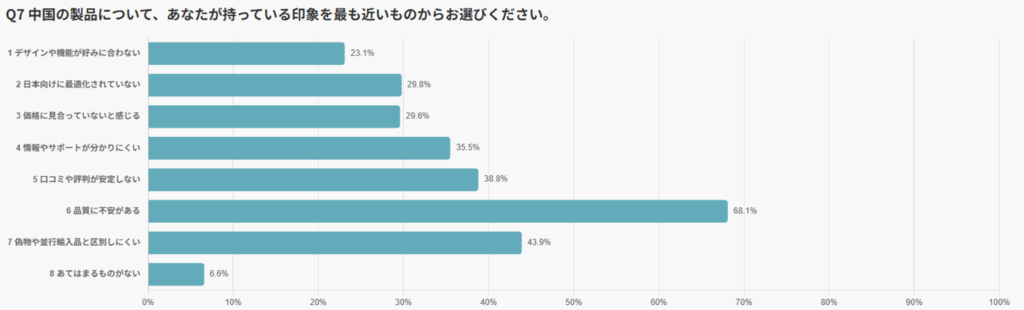

Chinese Products: Concerns Over Quality and Counterfeit Risks

The most commonly selected perception of Chinese products was “concerned about product quality” at 68.1%.

This was followed by “difficult to distinguish from counterfeits or gray-market imports” at 43.9%, and “reviews and reputation are inconsistent” at 38.8%, showing that issues related to reliability dominate the responses.

Additionally, 35.5% selected “information and customer support are unclear,” indicating widespread concerns regarding safety and peace of mind when using these products.

These results show that Chinese products tend to attract concentrated concerns around quality, authenticity, and reputation.

The wide variation in product types and price ranges also appears to influence this perception, as inconsistencies in information accuracy and communication methods likely contribute to unstable evaluations.

Meanwhile, functional concerns such as “design does not match my preferences” (23.1%) were relatively low, suggesting that consumers’ evaluations are shaped more by trust-related factors than by appearance or usability.

Given these tendencies, clearly presenting quality standards and certification systems is expected to be a crucial first step in building trust.

Enhancing transparency around official distribution channels and strengthening warranty structures can also be effective—if consumers can reliably verify authenticity, much of their anxiety is likely to diminish.

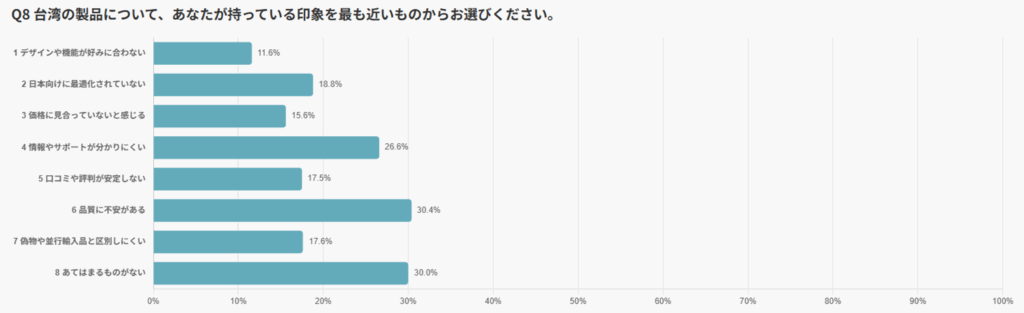

Taiwanese Products: Coexistence of Cautious Quality Perceptions and Generally Neutral Impressions

The most frequently selected perception of Taiwanese products was “concerned about product quality” at 30.4%.

However, this figure is not particularly high compared with other countries, and notably, it does not indicate a strong or overwhelming negative sentiment.

Other concerns included “information and customer support are unclear” (26.6%) and “not optimized for the Japanese market” (18.8%), suggesting some challenges related to user experience.

At the same time, 30.0% of respondents chose “none of the above,” indicating that a significant portion of consumers do not hold any specific negative impression.

This highlights a largely neutral, neither strongly positive nor negative perception—a characteristic that stands out compared with other countries.

Because there are few prominent drawbacks, evaluations tend to be more widely dispersed.

Taiwanese products already hold a certain presence in the Japanese market, and although some areas for improvement—particularly related to quality—were noted, there is no strong sense of distrust or rejection among consumers.

If product information becomes more transparent and customer support systems are strengthened, this category has strong potential for further improvement in consumer evaluation.

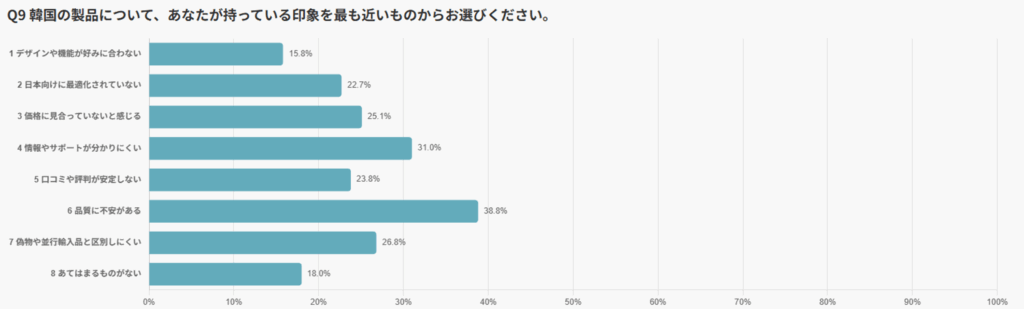

Korean Products: Quality Perceptions and Information Clarity as Key Improvement Areas

The most frequently cited perception of Korean products was “concerned about product quality” at 38.8%.

This was followed by “information and customer support are unclear” (31.0%) and “does not feel worth the price” (25.1%), indicating concerns across both quality and support dimensions.

Many other items also hovered around the 20% range, suggesting that rather than one specific issue standing out, consumers see room for improvement across multiple aspects.

The distribution of responses indicates a persistent cautious attitude toward Korean products.

Because evaluations tend to vary widely by category—such as beauty products versus home appliances—consumers appear to be actively trying to distinguish differences between items.

In addition, the fact that 31% reported difficulty obtaining clear information suggests that consumers lack enough decision-making materials before purchasing, which becomes a barrier.

For manufacturers, strengthening quality assurances and improving the transparency of customer support are likely to be critical strategies.

Since Korean products often have different strengths depending on the category, creating an environment where the unique value of each product is clearly explained will play a direct role in building trust.

Conclusion

The survey of 533 respondents revealed clear differences in the types of concerns Japanese consumers have toward foreign-made products.

For the U.S. and the U.K., the dominant issue was insufficient localization;

for Canada and Australia, it was limited availability of information;

and for India, China, and South Korea, concerns centered primarily on product quality.

In conclusion, evaluations of overseas products largely depend on how well reliable information and quality assurances are established.

The more transparent and trustworthy these elements are, the more positively foreign products are likely to be perceived.

For Influencer Marketing in Japan, Trust hotice

At hotice, we specialize in influencer marketing with a strong focus on Asia, and particularly Japan. Our multinational team offers end-to-end support, from matching the right influencers for your industry and goals, to campaign planning and performance tracking. With extensive experience working with leading companies, we ensure safe and effective promotions grounded in cultural awareness and compliance with local regulations.

If you are considering a strategic influencer campaign tailored to the Japanese market, we invite you to partner with hotice to achieve meaningful results.